India is making strides toward becoming a digitally empowered society at a breakneck speed. Initiatives to boost e-governance, the widespread use of smartphones, increased Internet access, and the rapid growth of digital payments is propelling the country’s progress toward a trillion-dollar digital economy by 2025.

Indian e-commerce market size

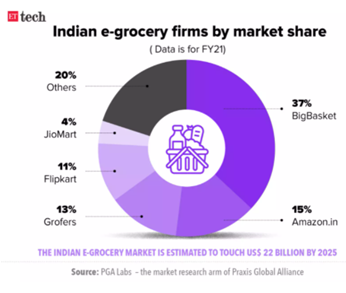

- The Indian online grocery market is expected to grow from $1.9 billion in 2019 to $ 18.2 billion in 2024, at a CAGR of 57 %.

- India became the 8th biggest market for e-commerce in 2020, following France and ahead of Canada, with a $50 billion turnover.

- The festive season in India helped boost e-commerce sales to $4.6 billion in October 2021.

- India has the third-largest online shopper base in 2020, behind China and the United States, with 140 million shoppers.

Table of Contents

The rise of the E-commerce market in India

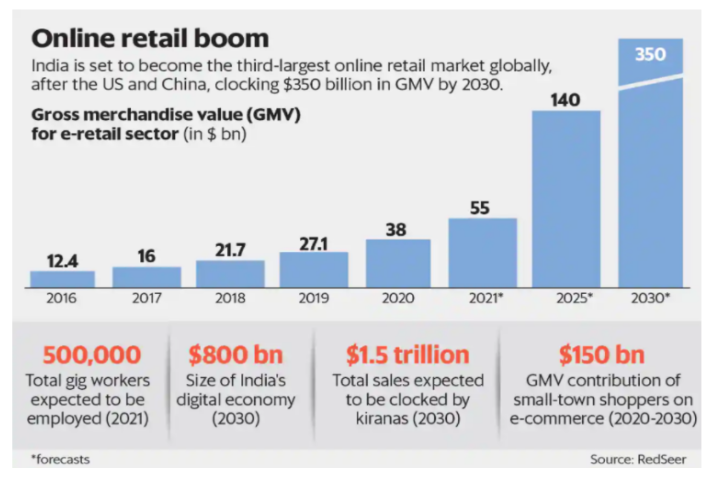

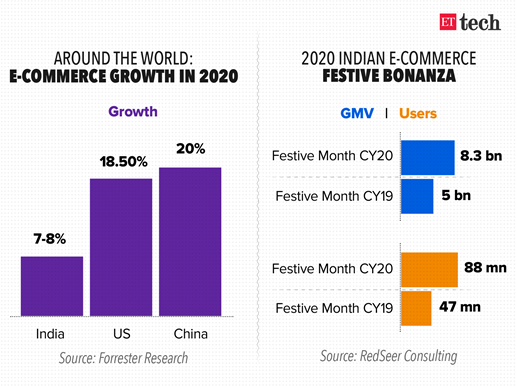

The Indian eCommerce market is expected to overtake the United States by 2034 and become the world’s second-largest E-commerce market. According to a new report from Forrester, Retail’s online penetration is expected to rise from 4.7% in 2019 to 10.7% by 2024. COVID accelerated consumers’ shift to online shopping and digital payments because of the slump in consumer expenditure, the slowdown in the economy, and the anxiety it created.

A large part of the industry’s growth can be attributed to increased internet and smartphone use. India’s internet users expanded to 784.59 million by July 2021 due to the ‘Digital India’ program implemented by the government. Wireless internet connections made up 97% of all internet connections in metropolitan areas, accounting for 61% of all connections.

The bulk of consumers shopping online are between the ages of 26 and 35, accounting for 37%, and 18 to 25, accounting for 26%, with 72% males and 28% females. According to the data intelligence company’s survey on the state of eCommerce in India, which was done across Tier 1, 2, and 3, usage of beauty e-commerce applications increased by 64% over the last year, while fashion e-commerce increased by 368%. The festive season has only fueled the growth of the two e-commerce domains, with shopaholics completing at least two purchases during the fashion festivals.

Behavioral Shift of Indian consumers due to pandemic

The Indian e-commerce business has benefited significantly from the pandemic since the lockdown introduced millions of people to the convenience of online purchasing and encouraged seasoned online shoppers to purchase more. It ushered in a new era of digital innovation in India, a country where Kirana Shops predominate.

Amazon and Flipkart, and industry observers remarked that the desire for social distance and a focus on safety during the pandemic drove millions of individuals to e-commerce platforms last year, not just in metros but also in tier III beyond. Another new development is a shift in the way people discover and purchase consumer goods. Nowadays, most people begin their shopping experience on an e-commerce website. According to a Grofers spokeswoman, 64% of new users on the site in the last year were first-time online grocery buyers, while 20% were completely new to e-commerce.

During the first week of the festive season in 2020, e-commerce sales in India totaled 290 billion Indian rupees, compared to 190 billion Indian rupees during the same period in 2019.

These customers are targeted by e-commerce platforms using native languages, offers, and discounts. Groceries, computers, headphones, furniture, consumer electronics, health and fitness products, household goods, personal grooming products, clothing, and books also saw an increase in demand from e-tailers.

As a result of the pandemic, small and medium-sized firms could adapt to the new e-commerce environment more quickly. Many first-timers who learned to navigate virtual aisles last year discovered that shopping online has silently transitioned from the compulsion to becoming part of everyday life, a comfortable, practical method to buy what the heart wishes, from the comfort and safety of home.

Top online Indian e-commerce platforms in India

eCommerce has transformed the way businesses are conducted in India. There are over 19,000 eCommerce businesses in India, and it’s difficult to break through the noise. Following are the most popular e-commerce websites in India, that have simplified the process of shopping online.

Leading e-commerce marketplaces

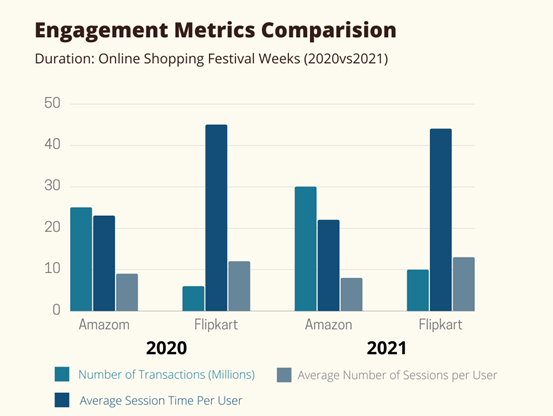

The battle of the e-commerce legends, Amazon, and Flipkart, is worth noting, with Flipkart’s active user base rising 83% in the 2021 online shopping festival compared to Amazon’s 72%. Even though Flipkart dominates in terms of engagement metrics like search frequency and active sessions, Amazon is winning in terms of transactions, significantly less average session times.

Amazon

Amazon is what Indian people think of when they think of online shopping. On average, Amazon receives 323 million monthly visitors (78%) online. Amazon started operating in India in 2013. This online marketplace has evolved to be India’s largest since its start, posing fierce competition to others.

Flipkart

Indian e-commerce pioneer Flipkart is often considered to be the country’s most successful enterprise. It started out as a bookshop like Amazon, but Flipkart has since expanded to include a wide range of products. Flipkart is expected to have 242.62 million monthly visitors.

Fashion and beauty e-commerce

Myntra faces stiff competition from Meesho, Ajio, and TataCliq. While Myntra accounted for about 46% of all purchases in 2020, Ajio accounted for approximately 69% of all transactions in 2021. The percentage of Myntra’s active users who also use Meesho, Ajio, and TataCliq has climbed dramatically this year, indicating that users are exploring several options.

Myntra

Myntra was purchased by Flipkart in 2014 and remained the favorite fashion platform for online shoppers. Approximately 50 million people visit Myntra monthly. Myntra has carved out a position for itself in the e-commerce world, earning people’s confidence in the process. The success mantra of Myntra is its hybrid logistics approach, which includes everything from special offers to Cash-on-Delivery perks. It pays close attention to its supply chain management and hires delivery agents with extensive experience.

Ajio

Ajio is an online store launched by Reliance ltd in 2016. When it comes to product categories, the “Fashion” category accounts for the majority of ajio.com’s eCommerce net sales. In the year 2021, its global net sales were $2,129.4 million.

Nykaa

Nykaa was established in 2012 and had been gaining popularity since then. About 10 million people visited the beauty and personal care retailer Nykaa’s website during the month of February 2022.

E-grocers

Bigbasket

With a vast selection of high-quality groceries at reasonable prices, Big Basket is India’s most popular and trusted online retailer. With a wide variety of products delivered to your home and a simple payment option, this is India’s largest online grocery store.

Blinkit / Grofers

Blinkit (formerly Grofers) is an Indian instant delivery service that delivers items within minutes. It was established in December 2013 and has its headquarters in Gurgaon. Over ten million Indians use Blinkit to shop for everything from grocery staples and vegetables to emergency supplies and electronic items, among other things. It currently delivers more than 100,000 orders per day and is dedicated to bringing the future of commerce to everyone in the Indian sub-continent.

Jiomart

It is an online grocery store that delivers more than 50,000 grocery items at a discount to your home via a fast delivery system. JioMart is a subsidiary of Jio Corporation. It collaborates with local businesses rather than building a warehouse infrastructure. Food items are sourced by these stores and delivered to the customers’ residences.

Recent developments in e-commerce

To stay on top of the competition, it is essential to keep abreast of the latest market developments so that you may be prepared for any future changes and also use the technology to your advantage.

- Zomato has announced that it will invest $400 million in developing a substantial presence in the quick commerce sector as it draws closer to profitability following an optimistic q3 in FY2022 (ending December 2021). Last year, it spent $225 million on Blinkit (previously Grofers), Shiprocket, and Magicpin to expand its rapid commerce business in India.

- Meesho unveils an integrated app for buyers & sellers. Especially sellers will be able to benefit from the app as it offers more features than the web versions previously provided. Some of its functions include support for sellers, order tracking, and inventory management.

- While 10-minute grocery delivery has been gaining momentum, Tata-owned egrocer Bigbasket plans to introduce BB express to the market, which will offer products within an hour. 62 large-scale dark stores will run the new service starting next month.

- Flipkart’s social commerce platform Shopsy has accrued 30 million downloads, mainly in the wake of the campaign, ‘It happens only on Shopsy.’ Competition intensifies in the social commerce space as Meesho takes on Flipkart and Amazon with convenient seller policies and lower prices.

- The e-commerce business will also see significant investments from global companies like Facebook, which is investing in Reliance Jio. Google has also made its first investment of US$ 4.5 billion in Jio Platforms, according to the company. Reliance Retail then acquired Future Group, further establishing the Ambani Group’s foothold in the e-commerce market.

Categories

E-commerce will contribute to 40% of non-grocery retail in India, which includes electronics and fashion, and 6% of the country’s general medicine and grocery purchases by 2030. The following categories are predicted to make a significant impact on eCommerce income in the future:

- Fashion – fashion accounts for the lion’s share of everything sold online in India. Clothing products account for over 35% of total income earned by online sales.

- Groceries – It’s no longer necessary to go to a store to get everyday necessities such as toiletries or cooking oil. For people who don’t have the time to go to the market on a regular basis, an online system like this is ideal.

- Consumer Electronics – E-commerce sites are ideal for buying and selling consumer electronics such as computers, smartphones, and digital cameras. India is anticipated to become the world’s fifth-largest consumer durable market by 2025.

Post pandemic shopping behavior of Indians

The retail market in India shrank by 5%, and GDP shrank by 7.3% in the fiscal year that ended in March 2021 as a result of prolonged lockdowns across the country. A multi-month shutdown of the e-retail market resulted in an increase of 5 percent in sales to $38 billion.

During the first 12–18 months of the pandemic, e-commerce categories experienced a wide range of growth and recovery patterns: the mobiles and electronics categories experienced a one-time growth spurt; frequent-use categories such as grocery, household, and personal care continued to accelerate; and discretionary categories such as fashion and travel products experienced slower growth but began to recover in 2021.

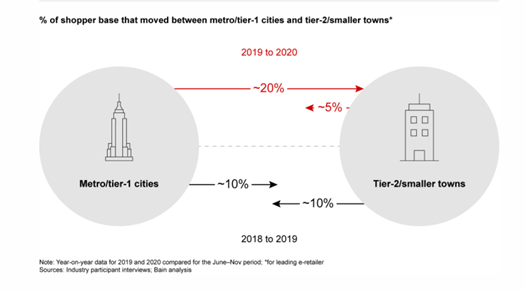

2020 saw a shift from urbanization to reverse migration, which fueled rapid growth in smaller communities.

The Indian e-retail market is predicted to increase at a rate of 25 percent to 30 percent per year over the next five years, reaching $120–140 billion by FY26, a rate that is higher than that of the Modern Trade sector. Small-town India will be the driving force behind this expansion, accounting for four out of every five new shoppers. As a result of the pandemic, reverse migration from metropolitan areas fueled even more rapid growth in smaller communities. Women and elderly buyers, in addition to small towns, are continuing to grow the e-commerce customer base.

What is the future when it comes to advertising in India

Small and medium businesses (MSME) in India have benefited from the E-commerce industry’s financing, technology, and training resources, which have a positive ripple effect on other sectors. Innovations like digital payments, hyper-local logistics, analytics-driven customer engagement, and digital advertisements will likely support the sector’s expansion. Improving customer satisfaction and increasing tax revenue are just a few of the benefits that will accrue as a result of the E-commerce sector’s development. By 2022, 859 million people are expected to be using smartphones.

Final thoughts

Advertisement is constantly evolving to meet the needs of today’s consumers. These improvements all have one thing in common: Developing an eCommerce marketing strategy that can attract new customers.

If you’re seeking someone to help you streamline and automate your marketing strategy, contact our specialists at info@paxcom.net