Embracing Digital Transformation in the brave new world has led businesses to explore the hidden potential of ultimate growth. Be it any industry or service, “Digital” treats all as “Equal.” While everyone in this world is battling against the pandemic, having an online presence has become a boon for many small-medium-large-sized businesses. When one can have the world at their fingertips, do things in the comfort of their home, have a safer option-what else would they need in such difficult times?

Having said that, we would also like to shed light on one of the businesses that resembled a massive surge in the e-Commerce domain in 2020. Some of you might have already guessed some answers; well, if you thought of eGroceries, you’re right! Within a few months, the demand for online groceries has reached superior heights-a barely foreseen situation even many years down the road. Here is how the rise was evident in almost all countries.

According to Morgan and Stanley, the eGrocery sector has become the fastest-growing segment, with a CAGR of 141% in 2020. However, it is expected to grow at a CAGR of 23.7% in the forecast period from 2021 to 2025. Solely, the eGrocery sector contributes to 12.5% of the total online sales.

The above figures do look promising. Here’s a sneak peek at how promising the eGroceries market in India looks. Let’s dive in!

Table of Contents

An Insight into eGroceries Business in India

Market Scenario

It is no secret that the preference for online grocery purchases became more visible after the COVID-19 outbreak. With various restrictions and social distancing norms, consumers nowadays prefer purchasing almost everything online as it’s convenient, viable, and, most importantly, a safer option. The dependency of customers on online platforms has provided the market with several growth avenues.

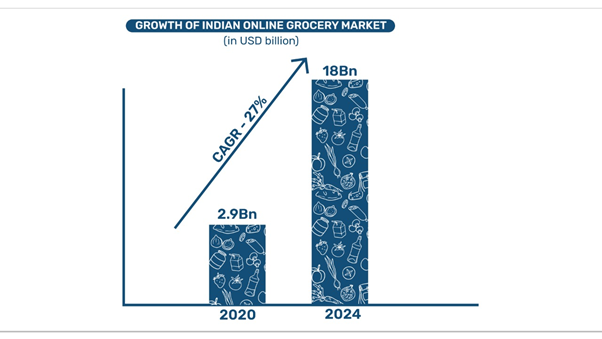

In India, the online grocery market was valued at 2.9 billion in 2020. It has been forecasted that the overall e-Commerce business will grow at a CAGR (Compound Annual Growth Rate) of 27% to reach $18 billion by 2024. Also, in the next five years, the eGroceries business will grow by 8x due to factors like growing urbanization, evolving consumer lifestyles, and the tech-savvy generation’s demand for convenience.

As giant market players like Reliance and BigBasket are willing to pull their A-game to deliver groceries to your doorstep, the eGrocery market is going to be the next battleground for potential growth.

As per Grand View Research, in 2020, South India held the largest revenue share of 34.6%. In the Southern region, the highest number of online consumers are located in Chennai and Bangalore. The credit for the regional growth goes to giants such as BigBasket, Grofers, and Amazon Pantry. Apparently, Big Basket has been the leading eGrocery player in Hyderabad and Bangalore.

If we talk about West India, this region has been projected as the second-fastest-growing region with a CAGR of 37.3%. One of the prime reasons for the rise is the consistently increasing adoption of eGrocery by tech-savvy millennials and working professionals. West Indian cities such as Pune and Mumbai have experienced the maximum upsurge in online grocery delivery apps from 2020 to date.

With the above data, it can be concluded that such a significant shift has led to an undeniable boost in the eGrocery online market growth.

Key Players in the Indian Online Groceries Market

The Indian market is characterized and fragmented by fierce competition amongst some of the key players in the e-commerce industry. The growth potential that has been uncovered after the pandemic has put these players at their feet. Their efforts are helping them expand their business geographically and motivating them to provide better services.

Here are some of the best players in the eGrocery market in India-

- Big Basket

- Amazon Fresh

- Grofers

- Reliance JioMart

- Swiggy

- Milkbasket

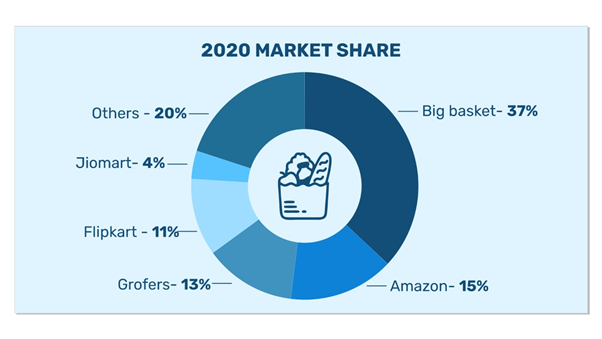

Big Basket is India’s most popular online grocery platform. According to the research from PGA Labs, Big Basket remained the market leader, owning a 37% market share in the fiscal year 2021.

Closely following was Amazon, with a total of 15% market share. In November 2020, Amazon India started operating its online grocery store, Amazon Fresh, in four more cities: Chennai, Kolkata, Ahmedabad, and Pune. They were able to initiate this expansion with the aid of their specialized geographical networks. All these efforts facilitated ultra-fast delivery services for groceries and other essential items under the Amazon Fresh Store and helped them gain the second highest market share.

Grofers had a 13% market share, Flipkart grabbed 11%, and Reliance’s JioMart had a market share of 4%. However, they have proved to be one of the most promising entries into the online grocery space in a short span of time. Their partnership with WhatsApp was one of the reasons for such a bang-on entry. One of their primary motives is to reach out to a significant chunk of the country’s population, provide eGrocery services with ease and efficiency, and eventually grow the customer base. The rest of the 20% went to other players in the same domain.

Since now we are aware of the market scenario, let’s have a look at the aspects that have led to the growth of the eGroceries market.

Factors driving the growth in eGroceries Market

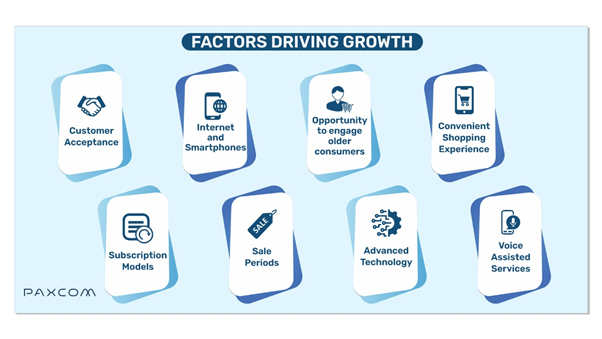

Customer Acceptance

The emergence of advanced technologies has led to a radical shift in the e-commerce industry in recent years. The significant changes, such as personalized services, utilization of automation services, and optimization of transaction processes, helped the sector grow further. Such perks have come to actual use for customers at the time of the current pandemic.

In a survey conducted by an Indian university in 2017, participants with online shopping experience were asked to specify products that they purchased over the internet. Apparels were the primary product purchased by 62-65% of people over the internet. Consumers also preferred to buy other products such as footwear, electronics, books, CDs, cosmetics, jewelry, etc.

However, only 7% of the respondents purchased grocery products through the internet. This happened despite the fact that 52% of the respondents were already aware of the online grocery websites.

Contrary to this, the current pandemic has undoubtedly attracted many consumers to online shopping. The nationwide lockdowns, social distancing norms, personal safety, etc., have been the crucial factors for such a shift in grocery purchasing patterns.

According to a report prepared by the Times of India, a 76% growth in online shopping was recorded last year. Another study by LocalCircles found that 80% of people ordered groceries online for convenience and not price. With such a golden opportunity in hand, market players like JioMart, Zomato, and Swiggy have revamped their platforms and have already begun selling e-groceries. Other retail brands in this domain, like Grofers, BigBasket, Amazon Pantry, etc., have also witnessed an enormous surge of about 60% in the sale of groceries in the current pandemic scenario.

It is no surprise that the changes in online shopping activities (especially online grocery shopping) will outlast the COVID-19 pandemic. The current customer base is quite strong. However, there will still be a considerable boost in these numbers in the future-contributing to a notably larger eGrocery market size.

Penetration-Internet and Smartphones

The affordability of mobile phones and the availability of cheaper data plans have made Indians hooked on their smartphones. They have brought about a change in the way we live, and it’s hard to imagine a life without them. Cybermedia Research (CMR) highlights that the average Indian spends 1,800+ hours per year on their smartphone, which is about one-third of their waking hours.

According to a report by Statista, the number of smartphone users in India in 2019 was around 634.58 million. However, this number has grown by a whopping 126 million as of 2021, leading to a total of 760.53 million smartphone users in the country. Adding a feather to the cap, the upsurge in smartphone users also introduced people to eGrocery apps.

In 2020, JioMart will surpass 50 lakh downloads. In July, it crossed the record-breaking 4 lakh daily order figure. Compared to that, Big Basket did over 250-350K orders while Grofers and Amazon Pantry clocked over 100K orders each. Furthermore, the GPS tracking systems and smartphone features to track the ordered product/s encourage people to use such eGrocery apps often.

This immense increase in the usage of smartphones and downloads of eGrocery apps has enabled eGrocery market players to reach a wider crowd.

An opportunity to engage older consumers

The grocery shopping patterns have changed not only for the tech-savvy younger generation but also for the older generation. Yes, you read that right!

During the pandemic, because of various restrictions, visiting grocery stores wasn’t that feasible and safe. This affected older citizens as they were habitual of buying groceries from brick-and-mortar stores. However, they too had to switch to online grocery shopping due to the pandemic.

Also, according to a survey by Rakuten Insight on Indian online shopping behavior, in May 2020, consumers aged 55 years and above purchased substantially more online than other age groups amidst the pandemic scenario. The most frequently purchased items were food, groceries, household cleaning products, and personal hygiene products. With the realization of how convenient and safe it is to get products delivered to your doorstep; even older citizens have changed their grocery shopping patterns.

Convenient Shopping Experience

In a survey conducted by LocalCircles, 80% of consumers said the key reason for them or their family to order groceries online during the lockdown was convenience, like doorstep/contactless delivery, while 14 percent said availability and selection, and 2 percent said the better price was their main reason.

eGrocery stores have an extensive variety of products available compared to what you find at your local Kirana store. You can effortlessly browse the virtual shopping aisles round the clock without leaving the comfort of your home. Many sites also have online chat facilities that allow you to interact in real-time to sort out any problems you might be having. Another significant advantage of shopping online is getting everything under one roof. On the contrary, grocery shopping from local Kirana shops fails to provide such comfort as customers have to wander from place to place to get all the items they need. Another feather in the cap is the presence of customer support in the case of any discrepancies. This thoughtful effort by the eGrocery platforms has fascinated many consumers to transform their grocery shopping regime.

The products sold by these stores assure firm quality control. Additionally, their tie-ups with trusted FMCG and private labels have helped them establish trust and credibility.

Subscription Models

The eGrocery platforms haven’t just grown and reached the level that they are today out of nowhere. There are a lot of marketing schemes involved in the radical growth of these platforms. One such campaign is the “Subscription Model.”

RedSeer reported that the Monthly Subscription Plans of online grocery platforms had helped them convert about 30-40% of their total consumer base. The report also emphasizes that the critical factors of swift subscription adoption are affordable pricing and numerous benefits, ranging from price savings via cashback and discounts to free and faster delivery options.

Currently, various subscriptions are available for daily grocery items like milk, fruits, vegetables, and other dairy products. Some of the platforms providing this service include BB Daily, MilkBasket, Supr Daily, and so on. To make daily grocery shopping easier for people, a few additional benefits that these platforms provide are-

- Daily Delivery before 7 AM

- There is no minimum limit on the number of products to be purchased

- Freedom to Pause/Resume the Subscription whenever needed

Even Amazon has a subscription-based service that allows users to shop for essential groceries without any hitch. These strategies have highly benefited many people, inclusive of the working class, as they usually don’t have time to go grocery shop.

Sale Periods

The eGrocery platforms are a major center of attraction during their “sale” periods. With growing competition nowadays, every known brand has started participating and providing appealing discounts, coupons, and cashback offers during this high traffic period. It has also become a necessity for the major eGrocery brands to offer such incentives as people now prefer to get the products at the lowest price possible. They take no time to switch from one platform to the other if they have not done so.

Grocery shopping is usually done at the beginning of every month in most households. Keeping that in mind, Grofers and Amazon have begun running “Houseful Sales” and “Super Value Days,” respectively, from every 1st to 7th of the month. All the major players have adopted such strategies to primarily attract their regular as well as new customers and gain incremental orders.

Advanced Technologies Further Fuel the Growth

The advancements in AI (Artificial Intelligence), ML (Machine Learning), and the adoption of Big Data Technologies have greatly benefited the e-commerce industry.

Big Data Analytics (BDA) with ML allows eGrocery platforms to identify the optimal price, determine the category of profitable customers and related goods, decide the ideal inventory level, etc. AI helps collect the required data from all the avenues such as – Chatbots, Mobile Messaging, Social Media, Customer Service Interactions, etc.

This data, when fed to Big Data Analytics Software, facilitates useful analysis to take actions on. With the advent of technology, price comparison apps, and other such reasons, small and large-scale grocery stores can use advanced analytical capabilities to magnify product prices throughout the day.

Voice Assisted Services

Nowadays, people have gotten used to the idea of getting everything at their fingertips. Hence, as technology is advancing, customers will want to make minimum efforts to shop online. Voice Assistance is the future of online shopping and makes the experience even more amazing. It curates the search results and recommendations according to the customer’s requirements.

Some of the significant eGrocery platforms have partnered with Google to offer voice-activated services. Amazon integrated Alexa into its app. Similarly, the Flipkart and BigBasket Mobile Apps also added a Voice Assistant to ease the shopping experience. Even if voice shopping in the e-commerce sector is in its initial phase, in the coming years, the organizations that adopt this technology will grow more extensively than other prominent names.

Now, when we have understood the factors that led to growth, let’s learn about some mergers and acquisitions that gained the limelight in the eGrocery sector recently.

Merger and Acquisitions that made News

The recent acquisition of Big Basket by the Tata Group was made to drive win-win synergies in terms of topline and costs. Big Basket is the only second e-commerce Indian vertical player to have accomplished the milestone, indicating the vast growth potential of the eGrocery business.

Its gross sales clocked $1.1 billion at the end of FY2020-21, as the pandemic fueled the online grocery business.

The association of these two companies means that Big Basket can enter into different segments while allowing both companies to cross-sell products on each other’s platforms. “On the one hand, Tatas have been trying to expand their presence in the retail segment; on the other hand, Big Basket, which has reached a plateau in its growth graph, needs a partner that has a strong presence in the offline segment,” said Sanchit Vir Gogia, Chief Analyst & CEO, Greyhound Research.

Another merger that made the news was Zomato acquiring a 9.3% stake in the online grocery platform Grofers. The acquisition had been planned amid Zomato’s ongoing efforts to launch its initial public offering (IPO) in India. Also, the Economic Times reported that Zomato was planning to invest a hefty amount of 100 million dollars in Grofers. These funds will definitely help Grofers fight its biggest rival-Big Basket!

Social media has definitely become an unavoidable aspect of our daily lives, and more than 86% of people use social media at least once every day. With such mergers and cutthroat competition, online grocery channels have realized the power social media holds.

Online Grocery Branding through Social Media Marketing

Social Media platforms have already influenced the younger generation all across the globe. Now, these platforms are not only used by individuals but also by businesses from various industries. eGrocery market players are no exception to this. After realizing the power of having a presence on social media, e-grocers have begun spreading their brand awareness using this powerful tool. Here is how some renowned names have grabbed the opportunity and made the most of it!

BigBasket runs a social media campaign # GharLeAoBigBasket on Facebook. Here they post creatives with captions that portray situations about how exactly BigBasket benefits people. Another campaign they follow is # DetoxWithBB on Instagram. Here, BigBasket posts health tips through photos of detoxifying food items, with the aim of helping their viewers achieve a healthier diet.

The other player that grabbed the attention of people on social media is Grofers. They used the # GrofersSeMangao campaign on their Instagram page to encourage their viewers to order from Grofers rather than buy the same product from local grocery stores. They also collaborated with TVF and Chef Sanjeev Kapoor. This had a massive impact on their social media branding. It is pretty evident that a drastic change has been brought to the online shopping culture post-COVID-19. Not one, but many factors have helped in skyrocketing the use of eGrocery apps.

Despite the huge success in FY2020-21, there is still a section of our society that is not interested in shopping online. They pose a challenge to the online eGrocery stores. Below, let’s discover why it is so.

Challenges for the Indian Online Grocery Market

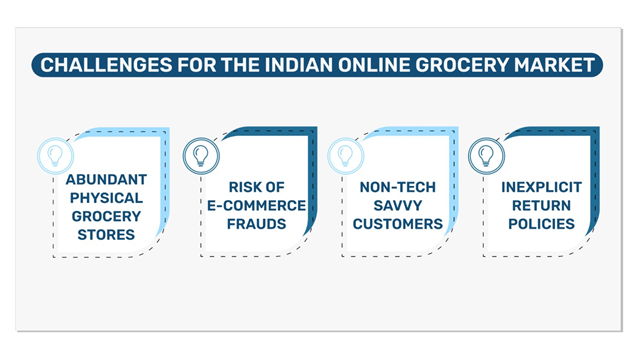

Presence of Abundant Physical Grocery Stores

In India, you can easily find many physical grocery stores spread across the local areas. Currently, only approximately 0.15% (around 2 million out of 1.35 billion) of Indians make purchases through online platforms. The market is dominated by about 12 million local physical grocery stores. Traditional Indian families have always preferred purchasing groceries from familiar shopkeepers, as the practice has continued for a long time.

Such local stores thrive mainly because of their geographical proximity. Now, grocery store owners are aware of the methods adopted by giants in the online grocery industry, and they are striving to keep up. The store owners have started offering attractive incentives like credit facilities, lower prices for regular customers, free delivery, and so on. The tremendous just-in-time leverage they possess keeps a stock of items in high demand, which saves them from expenses that e-grocers can’t escape.

Potential Risk of e-Commerce Fraud

According to the insights of CyberSource, e-commerce businesses annually lose 0.8-0.9% of their sales due to fraudulent activities. Cyber threats are one of the primary reasons why some people don’t trust online e-grocery platforms. Even banks have not been able to promote the e-commerce industry adequately. They have no appropriate policies and standards for online transactions, and this gap leads to losses from instances like credit card fraud, etc.!

Non-tech Savvy Customers

As per a study, 37% of the online shoppers were aged between 25-34 years, and 8% were above 55 years of age, totaling less than 1% of all online shoppers. There are multiple reasons behind these not-so-favorable statistics.

The primary reason behind this is the lack of non-tech savvy customers’ interest in advancing technologies. This chunk of the population has already spent most of their lives shopping at physical stores. Now they’re reluctant and orthodox about changing their habits.

To attract such customers, some of the major players have already begun strategizing to provide an easy grocery shopping experience. One such effort was to integrate their platforms with “Voice Assisted Services.” However, as per GlobalData consumer research, only 3.1% of users used voice commands for grocery shopping. This data indicates that a considerable chunk of the population still needs to adapt to such practices.

Inexplicit Return Policies

Ideally, if a customer purchases online and is not satisfied with the product, they have the right to get a replacement or refund. However, some e-commerce platforms that also cater to grocery sales do not guarantee any exchanges or refunds if the purchased item/s does not meet the customer’s expectations.

Such policies are practically responsible for discouraging online shoppers from purchasing any product from those platforms anytime soon. For the eGrocery market to grow impeccably, companies must have easy and transparent return policies. Additionally, having a trained staff that can successfully assist unhappy/unsatisfied customers is equally important.

Summary

A recent report indicates that the trend of online grocery shopping is likely to increase by two folds post-pandemic. This year has witnessed a 76% growth in online grocery shopping. Therefore, many renowned brands, like JioMart, Swiggy, and Zomato, have started selling groceries online. Other eGrocery brands, like BigBasket, Grofers, Amazon, etc., have also witnessed an escalation of about 60% in the sale of groceries during the pandemic. Many CEOs of organizations have seen a 50% jump in orders as compared to pre-COVID-19 days.

In summation, the eGrocery players have immense untapped opportunities that will help them grow their revenue rapidly. Earlier, the target audience was scattered in Tier-I cities, but now, even Tier-II cities will be on the list.

It is rightly said-The first impression is the last impression! With a bright future that the eGrocery sector beholds, focusing on ingenious business models, reducing margin prices, and forwarding the same benefits to customers will likely go a long way towards helping the e-grocers to accomplish their goals.

About Paxcom

Over the years, Paxcom has helped many brands launch and grow their brands on Amazon and other major e-commerce platforms. Whether your brand is an already established name or is planning to enter the market-Paxcom has got you covered.

To learn more about how we assist brands in creating a presence, growing, and skyrocketing sales, contact us at info@paxcom.net.