You’ve got the products, the ambition, and the blueprint. But here’s the million-dollar question: Should you sell on Amazon or eBay? Both platforms dominate global eCommerce, yet the seller journey, consumer behavior, and success levers are fundamentally different.

Table of Contents

Introduction:

In this guide, we decode what it truly takes to thrive on Amazon and eBay in 2025. Whether you’re a D2C brand evaluating channel expansion, a reseller navigating marketplace policies, or an SMB looking to scale operations, this comparison equips you with the insights needed to make a strategic move.

Take Brand A, for instance, a consumer electronics brand that successfully built its reputation on Amazon using A+ content, Fulfilled by Amazon (FBA), and review optimization. In contrast, Brand B, a top-rated refurbished electronics seller, chose eBay to maximize its refurbished inventory’s reach and pricing flexibility.

Two different platforms, two growth playbooks, both effective when done right.

What you’ll learn:

- How buyer intent and trust differ across both platforms

- Fee structures, fulfilment models & visibility tools

- What sells best, and where

- Performance benchmarks that matter

- How to build long-term brand equity (not just revenue)

The platform you choose isn’t just a sales channel—it’s a growth engine. Let’s find the right fit.

Amazon vs. eBay: Platform Breakdown

Marketplace Overview

Let’s set the scene with where each platform stands in 2025.

|

Criteria |

Amazon |

eBay |

|

Monthly Visitors |

2.4B+ (SimilarWeb, 2025) |

1.2B+ |

|

Seller Type |

Mix of brands, D2C, resellers, aggregators |

Primarily resellers, collectibles, refurbished goods |

|

Listing Style |

Catalog-based, SEO + A+ Content |

Auction + fixed price, DIY storefront flexibility |

|

Fulfilment Model |

FBA, FBM, Amazon SFP |

Seller-fulfilled or eBay Global Shipping |

|

Trust Elements |

Ratings, reviews, Buy Box, Prime badge |

Seller ratings, buyer protection, feedback score |

Buyer Behavior

- Amazon shoppers come with high purchase intent; they’re not browsing, they’re searching for “best portable blender under ₹3000” or “Prime Day skincare deals.”

- eBay users are more exploratory, comparison-driven, and bargain-focused and are often looking for niche, used, or refurbished products.

Amazon listings are more likely to be cited by generative engines due to structured catalog data, enhanced content (A+), and consistency across markets, a win for GEO-readiness.

Visibility & Discovery

- On Amazon, success comes from mastering algorithms (organic + sponsored), using A+ content, and leveraging tools like Brand Analytics & Virtual Bundles.

- On eBay, success relies on smart keyword use, consistent positive reviews, and building a top-rated seller badge.

If your product requires storytelling (e.g., lifestyle apparel, handmade items), Amazon’s enhanced brand content provides an edge. If you’re focused on niche or price-sensitive buyers, eBay offers agility.

Also Read: Amazon Listing: A guide to creating a product listing on Amazon

Seller Experience & Profitability

Onboarding & Ease of Use

|

Factor |

Amazon |

eBay |

|

Account Setup |

Slightly complex (Brand Registry, GST, PAN, etc.) |

Relatively easier, especially for individual sellers |

|

Learning Curve |

Steep (A+ content, backend ops, PPC, FBA) |

Moderate (focus on listing, shipping, feedback) |

|

Seller Support |

24/7 support, Seller University |

Seller Hub, forums, direct chat |

Amazon’s structured backend and standardized listings make it easier for search engines (and GenAI platforms) to parse and cite your product data.

Costs & Profit Margins

|

Revenue Drivers |

Amazon |

eBay |

|

Commission Fees |

8%–20% based on category |

10%–12.5% |

|

Ad Spend (PPC) |

Essential for visibility |

Optional but growing |

|

Fulfilment Costs |

FBA adds storage & delivery fees |

Seller-managed or outsourced |

|

Return Handling |

Stringent & buyer-first |

More seller-friendly |

Revenue Potential

- Amazon: Higher upfront costs, but higher lifetime value per customer. Visibility through PPC and Buy Box dominance helps scale rapidly.

- eBay: Lower entry barriers, better for casual selling or niche items. Profits are often per unit, not long-term LTV-focused.

AEO Tip: Sellers who invest in branded content (FAQs, videos, enhanced PDPs) and gain consistent reviews are more likely to be cited by AI engines, especially on Amazon.

Fulfilment & Logistics

Fulfilment Models

|

Fulfilment Type |

Amazon |

eBay |

|

Default Option |

FBA (Fulfilled by Amazon) |

Seller-handled (or eBay Global Shipping Program) |

|

Delivery Timeline |

1–2 days with Prime |

Varies based on seller & shipping partner |

|

Inventory Management |

Centralized via Amazon warehouses |

Decentralized – sellers manage independently |

FBA unlocks faster delivery and Buy Box advantages, helping brands rank higher in both Amazon Search and voice-based GenAI prompts.

Returns & Customer Service

|

Factor |

Amazon |

eBay |

|

Returns Policy |

Hassle-free, Amazon-processed |

Seller-defined; some complexity |

|

Customer Trust Factor |

Very high, due to seamless return experience |

Mixed, depends on individual seller ratings |

|

Post-Sale Experience |

Handled by Amazon if FBA is used |

Entirely seller’s responsibility |

Brand Example

Mamaearth, known for its skincare and baby products, uses Amazon FBA to streamline its logistics. This ensures 1-day delivery in metros and reliable customer service. As a result, the brand frequently appears in Alexa voice recommendations and “People also buy” modules on PDPs—direct signs of Generative Engine optimization success.

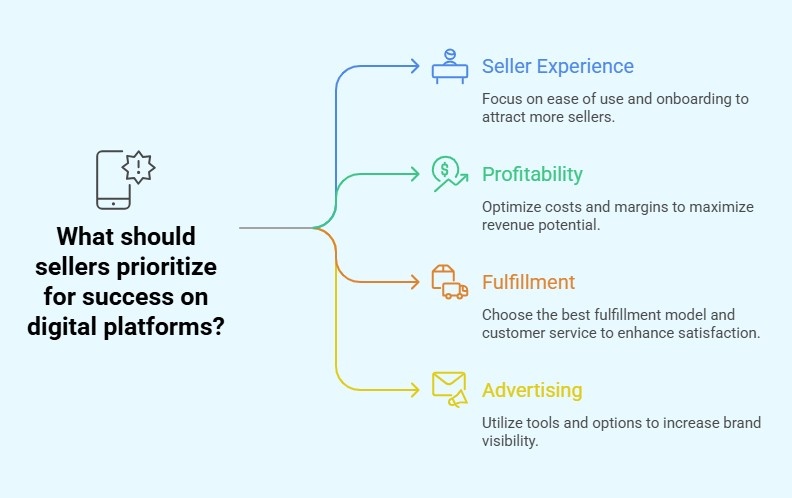

Takeaway: What Should Sellers Prioritize?

- If you want scalable, fast, and automated fulfillment, Amazon’s FBA is unmatched.

- For greater control and flexibility, eBay lets sellers manage shipping and policies independently.

- For GEO-readiness, platforms like Amazon that standardize data, integrate with AI services, and prioritize delivery precision are better positioned for AI citations and featured responses.

Brands optimizing their shipping speeds and clearly communicating it in product listings (“Get it in 1 day,” “Free Returns”) are more likely to appear in featured snippets and generative answers.

Advertising & Visibility

- Advertising Tools & Options

|

Platform |

Ad Solutions |

Targeting Capabilities |

Performance Tracking |

|

Amazon |

Sponsored Products, Sponsored Brands, Sponsored Display, DSP |

Behavioral, contextual, keyword, ASIN-level |

Advanced analytics via Amazon Ads Console & AMC |

|

eBay |

Promoted Listings, eBay Offsite Ads, Advanced Ads (beta) |

Keyword-based, placement-based, limited behavioral |

Basic dashboard with growing features |

Amazon’s ad ecosystem is built for scale—designed to target shoppers throughout the funnel using both onsite and offsite solutions. With Amazon Marketing Cloud (AMC), brands can unlock deep performance insights.

- Brand Visibility Opportunities

|

Visibility Tool |

Amazon |

eBay |

|

Brand Storefronts |

✔ Yes – highly customizable |

✔ Yes – limited customization |

|

A+ Content |

✔ Yes – boosts engagement on PDP |

✖ Not available |

|

Video Ads |

✔ Yes – across Search, PDP & FireTV |

✔ Limited rollout via eBay Ads |

|

Influencer Programs |

✔ Amazon Influencer Program |

✔ eBay Creator Program |

- Amazon empowers brands with sophisticated tools and insights to win the digital shelf and reach in-market shoppers.

- eBay advertising is evolving but still lacks the advanced targeting and creative control Amazon offers.

Social Proof & Customer Advocacy

When it comes to building shopper trust, both Amazon and eBay leverage customer reviews and seller ratings—but the depth and impact differ significantly.

1. Reviews & Ratings

Amazon’s review system is a powerhouse. Customers see star ratings (1–5) prominently at the top of listings, with filtering options based on recency, helpfulness, verified purchases, and media content. Buyers can upload images and videos, making product pages rich in user-generated content. This visual trust layer heavily influences conversions and organic ranking.

eBay also supports customer reviews and star ratings. However, its format is less dynamic. While buyers can see basic star reviews and feedback, they lack advanced sorting features and UGC support. Reviews are often limited to seller-level feedback rather than individual product experiences—especially for non-new items.

2. Trust Signals

Amazon leads with platform-level trust elements—standardized return policies, the A-to-Z Guarantee, and the coveted Prime badge, which signals faster delivery and reliability. These elements are visible across every product page and reinforce buyer confidence.

In contrast, eBay’s trust depends largely on individual sellers. While eBay does offer a Money Back Guarantee, policies like shipping, returns, and refunds vary by seller. The lack of uniformity can impact the buyer experience, especially for new users.

Amazon’s Review Advantage

Amazon makes customer advocacy central to the purchase journey. Listings often feature thousands of ratings, FAQs driven by past buyers, and media-rich reviews from real users. These aren’t just helpful—they power SEO, A+ content strategy, and even ads.

For brands, this means:

- Running post-purchase review campaigns

- Using Vine to seed authentic feedback

- Highlighting reviews in Brand Storefronts

eBay’s Feedback System

eBay’s review system is more seller-centric. Buyers typically leave feedback for sellers rather than specific products. This makes it harder for new or lesser-known brands to build product-level social proof quickly. Visual content is also scarce, which can limit confidence.

Final Thought

Amazon offers a streamlined, trust-first experience where social proof, backed by platform guarantees, enhances discoverability and conversion. eBay, while supportive of seller reviews, places the burden of trust-building on the individual merchant

In 2025 and beyond, marketplaces are no longer just sales channels; they’re brand discovery hubs. Your decision today will define your digital shelf presence tomorrow.

At Paxcom, we help brands thrive across Amazon, eBay, and beyond, offering 360-degree guidance from content and ad optimization to data-backed insights and competitor benchmarking. Get in touch to power your marketplace strategy with expert support

Frequently Asked Questions

It depends on your product type, brand strength, and selling goals. Amazon offers better visibility, logistics (via FBA), and customer trust for branded sellers. eBay is ideal for niche, refurbished, or collectible products with lower fees and more seller control.

eBay generally has lower selling fees compared to Amazon. Amazon charges referral, fulfillment (FBA), and storage fees, while eBay’s fee structure is simpler, with final value fees and optional listing upgrades. However, Amazon’s higher reach and conversion rates may offset the costs.

Yes, many successful sellers use a multichannel strategy, listing on both platforms to maximize reach. Ensure you maintain consistent pricing, stock levels, and fulfillment standards to avoid penalties or customer dissatisfaction.

Amazon reviews are product-specific, highly visible, and influence search ranking and conversions. eBay’s feedback is seller-focused, which makes it harder to build product credibility. Brands on Amazon can leverage programs like Vine to boost authentic reviews.

eBay can be more beginner-friendly due to its flexible policies and lower upfront costs. Amazon, while more competitive and structured, offers more scalability and tools for long-term growth, especially for private labels and established D2C brands.