In 2025, quick commerce isn’t just about speed, it’s about capturing high-intent shoppers at the exact moment of need. As platforms like Blinkit, Zepto, Instamart, Instacart, and Noon redefine convenience and compress the purchase journey to minutes, consumer expectations are shifting fast. For brands, q-commerce now acts as both a visibility engine and a rapid-conversion channel.

This guide breaks down the essentials, what quick commerce is, how it works, the platform landscape (India + global), and the strategic playbook every brand must master to win in this accelerated retail ecosystem.

Table of Contents

What is Quick Commerce?

Quick Commerce often referred to as the next phase of eCommerce, is a fulfilment model designed to deliver essentials within 15–60 minutes. Unlike traditional online retail, q-commerce platforms such as Blinkit, Zepto, Instamart, and BigBasket Now rely on micro-warehouses, dense delivery networks, and real-time inventory intelligence to fulfil orders at lightning speed.

It primarily covers high-velocity categories such as groceries, personal care, OTC pharma, household essentials, stationery, and snacks. With demand rising across urban India, quick commerce companies have now expanded to include impulse categories like gifting, electronics accessories, and beauty driven by the growing consumer expectation of “buy now, get now.”

This shift is backed by strong behavioural data:

- Over 70% of q-commerce shoppers purchase 3–4 times a week, showcasing strong repeat intent.

- Nearly 45–55% of users add cross-sell or recommended items, making quick commerce advertising more valuable than ever for driving ROAS and AOV.

Originally centered on everyday essentials, today’s quick commerce examples span:

• Groceries and fresh produce

• Personal care & beauty

• Pharmacy & wellness

• Stationery & office supplies

• Home & kitchen basics

• Gifting packs & seasonal items

• Small electronics & accessories

This shift has been enabled by:

• Micro-warehouses/dark stores placed close to residential clusters

• Optimized last-mile networks

• AI-driven demand forecasting

• Real-time product availability

• Quick commerce advertising that pushes in-the-moment decisions

As platforms scale, brands are leveraging quick commerce platforms not only for rapid fulfillment but also for visibility, product trials, and incremental sales making q-commerce one of the fastest-growing revenue channels in retail.

Quick Commerce in India: Market Growth & Consumer Shift

India is one of the world’s fastest-growing quick commerce markets, fueled by rising disposable incomes, urban density, and a clear behavioural shift toward “instant convenience.” What began with grocery essentials has now evolved into a multi-category ecosystem that serves everything from beauty and gifting to OTC pharma and home care.

According to Redseer (2024):

- India’s quick commerce market is expected to reach USD 5.5–6 billion by 2025, growing nearly 15x since 2020.

- Tier-1 cities still contribute nearly 80% of total demand, but Tier-2 expansion is accelerating due to improved delivery networks.

Bain & Company’s analysis shows that:

- Quick commerce accounts for 40–50% of India’s e-grocery spending.

- Unit economics have improved due to higher AOVs, better picking efficiency, and reduced delivery times driven by micro-fulfilment tech

Consumer habits also validate the rapid growth:

- 70%+ of Indian q-commerce customers repurchase within a week.

- Impulse-led purchases (snacks, beverages, bakery, chocolates) now account for 25–30% of total orders.

- Cross-category purchases have increased with platforms pushing personal care, home essentials, and OTC, reflecting higher trust and habit formation.

With India now being home to some of the world’s most efficient quick commerce platforms like Blinkit, Swiggy Instamart, Zepto, and BigBasket Now, the competition is shifting from “fast delivery” to “profitable delivery,” creating more advertising and brand placement opportunities.

Major Quick Commerce Platforms in India

India’s quick commerce platforms have evolved into high-intent demand engines, reshaping how consumers discover and shop for essentials, indulgences, and impulse categories. Here’s a streamlined view of the leading players shaping the quick commerce advertising landscape today.

- Blinkit

Blinkit remains the category pace-setter with 10–20 minute deliveries across major cities. Strengths:

- Exceptional for snacking, beverages, beauty, personal care, baby care, and gifting.

- Highly conversion-led layouts with widgets, hero banners, and curated shelves.

- Premium metro-heavy shoppers, resulting in higher AOVs and repeat cycles.

- Swiggy Instamart

Built on Swiggy’s hyperlocal backbone, Instamart balances speed with wide assortment. Strengths:

- Strongest in groceries, F&B, household care, dairy, frozen, and cleaning categories.

- Offers diverse formats: search ads, brand shelves, homepage visibility, and in-app sampling.

- High retention and frequency ideal for brands focused on repeat purchases.

- Zepto

Zepto’s precision-focused dark-store network positions it as a favourite among premium shoppers.Strengths:

- Growing rapidly in beauty, bakery, health foods, snacking, hygiene, gifting.

- AI-powered recommendation loops boost impulse/cart expansion.

- Highly brand-friendly for instant visibility and thematic campaigns.

- BigBasket Now (BB Now)

Backed by BigBasket’s ecosystem, BB Now blends reliability with speed. Strengths:

- Known for fresh produce, staples, home care, personal care.

- Great for brands prioritizing availability consistency and broad SKU depth.

Strong algorithmic replenishment and substitution logic.

Emerging & Supporting Quick Commerce Players

Flipkart Minutes

Flipkart is piloting hyperlocal delivery under Flipkart Minutes, focusing on everyday essentials and convenience-led SKUs. While still early-stage, it signals Flipkart’s push to close the fulfilment gap between traditional eCommerce and rapid delivery.

Amazon Now

Amazon Now was Amazon India’s initial experiment in express delivery for groceries and daily needs. Although it didn’t scale as expected, the infrastructure, learnings, and partner network built through Amazon Now now support Amazon Fresh’s faster fulfilment capabilities.

- Myntra M-Now

Myntra’s M-Now explored ultra-fast delivery for select fashion categories in metro cities. While not a full Q-commerce model, M-Now highlights how fashion marketplaces are testing hyperlocal fulfilment for time-sensitive occasions (events, gifting, last-minute apparel needs). - Nykaa Now

Nykaa Now launched as a rapid delivery layer for beauty and personal care essentials. The proposition combines Nykaa’s high-margin assortment with convenience-driven delivery, enabling the brand to tap into impulse and emergency beauty categories.

Global Quick Commerce Platforms

While India leads in hyperlocal innovation, several global markets are scaling quick commerce through their own dominant players. Here are the key ones shaping the global landscape:

Instacart (US)

The largest North American grocery-delivery ecosystem, Instacart blends retailer partnerships + rapid fulfilment to offer deliveries in as little as 30 minutes. Strong for CPG brands due to its retailer-backed inventory, deep data integrations, and robust advertising ecosystem.

Noon Minutes (Middle East)

Operating in UAE & KSA, Noon Minutes focuses on high-density fulfilment with ~15–20 minute delivery speeds. It has quickly become a preferred channel for FMCG, beauty, and personal care brands due to its fast adoption in urban centres.

Getir (Europe & US)

Originally from Turkey and now spread across multiple European cities, Getir pioneered the dark store + micro-fulfilment model. Strong in convenience categories and impulse baskets.

Gorillas (Europe)

Popular in Germany & France, Gorillas offers 10–20 minute delivery with a strong emphasis on curated assortments, fresh produce, and private-label expansion.

Deliveroo Hop (UK)

Deliveroo’s quick-commerce arm, offering ultrafast grocery delivery via partner dark stores. Strong for brands because it integrates restaurant + grocery discovery, expanding cross-category trial.

Why Quick Commerce Matters for Brands Today

Immediate Demand Capture (Real-Time Intent → Real-Time Sales)

Quick commerce advertising allows brands to tap into high-intent, need-it-now consumers. With India’s qCommerce market expected to reach $5.5B by 2025 (Redseer), the window to influence purchase decisions during micro-moments has never been stronger. Platforms like Zepto and Blinkit report that 70–80% of orders come from urgent or top-up missions, making visibility at the moment of demand the biggest sales lever.

Higher Repeat Purchases & Faster Category Rotation

Approximately 60–65% of qCommerce baskets are FMCG-driven, leading to significantly higher repurchase cycles compared to traditional eCommerce. Because quick commerce companies in India operate within 2–4 km delivery radiuses, replenishment behaviour becomes predictable—giving brands the ability to dominate repeat-use categories like beverages, biscuits, snacks, personal care, and home essentials.

Personalised Customer Experience at Scale

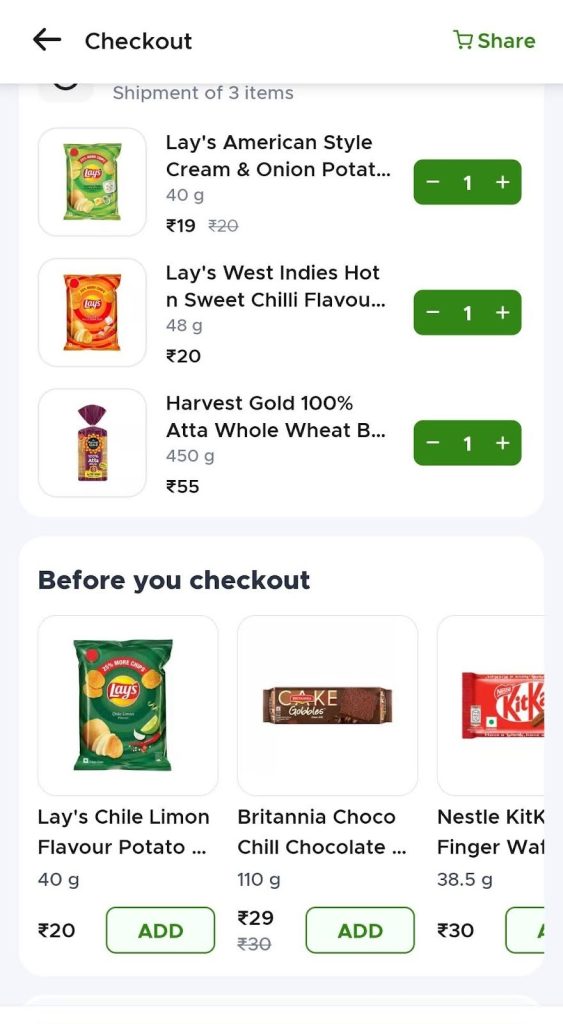

Personalised Recommendations, Blinkit

Suggested products, “Bought Together,” and “You Might Also Like” touchpoints influence a large chunk of purchases. Quick commerce platforms internal benchmarks show that recommendation widgets contribute nearly 20–25% of incremental sales for promoted SKUs. With rising competition, maintaining digital shelf visibility improves conversion rates across all quick commerce platforms.

Shorter Path to Purchase = Stronger ROI

The qCommerce path-to-purchase is under 2 minutes on average, with add-to-cart rates nearly 2.5x higher than traditional eCommerce (Blinkit & Instamart internal trends). This makes it a high-ROI avenue for brand activations, festival promos, new launches, and replenishable categories. Qcommerce platforms operate on micro-warehouse or dark-store networks placed within 2–3 km of high-density clusters.

This allows:

- Instant stock sync

- Automated picking systems

- Optimised rider routing

- Minimal order defects

Competitive Advantage Through Speed + Discovery

As qCommerce evolves into an everyday habit, India’s order volume grew 77% YoY in 2024 (Blinkit/Zepto market estimates), brands that establish early dominance secure “mindshare + market share” before the category gets saturated. With more platforms introducing 10–20 minute delivery layers (e.g., Flipkart Minutes, Nykaa Now, and Myntra MNow), the ecosystem is evolving beyond groceries into beauty, fashion, and electronics—solidifying quick commerce as a mainstream retail channel.

6. Sustainability & Last-Mile Innovation

As the category matures, platforms are increasingly focusing on sustainability:

- Electric two-wheelers for last-mile delivery

- Recyclable & minimal packaging

- Energy-efficient micro-warehouses

This directly supports the brand’s ESG positioning while reducing operational costs in the long run.

Winning qCommerce in 2026: How Paxcom Helps You Scale with Precision

Quick commerce has entered its next phase—where speed alone doesn’t win, but the combination of sharper targeting, stronger content, and real-time visibility does. As platforms evolve and consumer expectations rise, brands need partners who can move fast, course-correct faster, and bring all pieces of execution under one roof.

That’s where Paxcom steps in.

1. Precision-Led Ads & Campaign Management

Holiday learnings across marketplaces show one clear trend: campaign fatigue sets in faster than ever. To sustain ROAS in Q1 and beyond, brands need:

- faster creative refresh cycles,

- region-aligned messaging,

- trust-building formats over aggressive selling, and

- GEO-driven bidding decisions.

This is exactly how we approach quick commerce advertising, not by increasing volume, but by increasing relevance.

2. Content That Closes the Loop

Your ads start the story, but your content converts it.

Across Amazon, Flipkart, Blinkit, Zepto, and Instacart, consumers consistently responded to:

- benefit-first messaging,

- use-case-led visuals,

- enriched PDP storytelling,

- and seasonality-aligned keyword optimisation.

In Q1, shoppers are intentional. Your content needs to reflect that intent.

3. Digital Shelf Intelligence: Kinator at the Core

Kinator helps brands stay ahead by enabling:

- daily share-of-search tracking,

- competitor keyword and pricing shifts,

- banner tracking & compliance checks,

- stock + availability alerts across sellers and locations.

Q1 growth belongs to brands that don’t leave visibility to chance.

4. GEO Optimisation: Where Momentum Starts

Demand in qCommerce is now hyper-local. City-level shifts decide whether you scale or stall.

With GEO-backed insights, Paxcom helps you:

- reallocate inventory to high-momentum regions,

- launch micro-campaigns where traction already exists,

- identify markets where competitors are outpacing you,

- tailor pricing, bundling, and promotions by region.

Your next wave of growth won’t be national—it will be regional first.

Why This Matters for Your Brand in 2026

qCommerce is becoming the most competitive retail battleground. Success requires:

- faster decisions,

- cleaner data,

- sharper storytelling,

- and execution that holds up at scale.

Paxcom brings all four together, ads, content, digital shelf analytics, and GEO execution so brands can grow with consistency, not guesswork.

Ready to Scale Your qCommerce Performance?

If you’re planning to strengthen your footprint across Blinkit, Zepto, Swiggy Instamart, BigBasket Now, Flipkart Minutes, Amazon Now, or global platforms, let’s talk. Reach out at info@paxcom.net or request a tailored walkthrough with our qCommerce specialist team.

FAQ

What is Quick Commerce?

Quick Commerce (Q-Commerce) is a hyperlocal delivery model that fulfills orders within 10–30 minutes using dark stores and real-time routing. It focuses on essentials and impulse categories like groceries, snacks, beauty, and daily-use items.

Which are the major Quick Commerce platforms in India?

Leading platforms include Blinkit, Zepto, Swiggy Instamart, BigBasket Now, and emerging players like Flipkart Minutes, Amazon Now, Myntra M-Now, and Nykaa Now.

Why is Quick Commerce important for brands in 2025?

Because it captures high-intent shoppers, drives frequent repeat purchases, boosts visibility in crowded FMCG categories, and enables brands to test SKUs, pricing, and campaigns faster than traditional eCommerce.

What are examples of global Quick Commerce platforms?

Popular global players include Instacart (US), GoPuff (US), Getir (Europe), Deliveroo Hop (UK), and Noon Minutes (UAE)—each built on fast fulfilment and curated local inventory.

How can brands advertise effectively on Quick Commerce?

Success comes from sponsored listings, GEO-targeted ads, new-launch bursts, category banners, creative refreshes every 10–14 days, and aligning bidding with real-time inventory availability.

What categories perform best on Quick Commerce?

Top categories include FMCG, snacks & beverages, beauty & personal care, home essentials, stationery, and fast-growing ones like pet care and gifting SKUs.

What challenges do brands face in Quick Commerce?

Key challenges include stockouts, intense bid competition, limited assortment space, pricing volatility, and regional demand shifts—all requiring strong inventory discipline, GEO optimization, and digital shelf analytics.