Table of Contents

Introduction

Selling on Amazon today is less like arranging products neatly on a shelf and more like competing in a crowded marketplace where visibility changes by the minute. One moment your product is ranking high, winning the Buy Box, and pulling steady sales. The next, a competitor slashes prices, launches a bank offer, or racks up reviews that push you down the results page.

This is the reality of Amazon’s digital shelf, it is dynamic, data-heavy, and unforgiving. Winning here is not just about listing products, but about managing every variable that shapes discoverability, conversion, and profitability.

That’s where Amazon Digital Shelf Analytics becomes critical. Instead of reacting blindly, brands need real-time visibility into what drives performance across pricing, content, promotions, stock availability, and competitor activity. And with platforms like Kinator, brands not only track these shifts but turn them into actionable strategies, from identifying Buy Box leaks to spotting content gaps or monitoring price violations.

In this blog, we’ll break down the key levers of Amazon’s digital shelf and show how Kinator helps brands take control of them, turning complexity into growth.

Also Read: What is Digital Shelf Analytics?

What is Amazon Digital Shelf?

In a physical retail store, products compete for attention based on how and where they’re placed. The “eye-level shelf” often wins because that’s what customers see first. Amazon works in a similar way, but instead of aisles and shelves, it’s product pages, search results, and recommendations that shape visibility.

The Amazon digital shelf refers to every point where your product can appear on the platform’s search results, product detail pages, category rankings, and even ads. It’s the space where your brand competes for attention, clicks, and ultimately, conversions.

What makes this shelf so critical is that unlike traditional retail, there’s no limit to the number of competitors on the same shelf. A single category might have thousands of listings, with Amazon’s algorithm deciding who ranks on top. And much like the “prime spot” on a supermarket shelf, the first few search results on Amazon capture the majority of traffic and sales.

Key components of the Amazon digital shelf include:

- Content: Titles, bullet points, product descriptions, A+ content, and images that shape discoverability and conversion.

- Keywords: The terms your audience uses to find products like yours, and how well you’re optimized for them.

- Price & Promotion: Competitive, dynamic pricing that keeps you in check for the Buy Box.

- Availability: Inventory management that ensures your product is always in stock and visible.

- Ratings & Reviews: Social proof that heavily influences buyer decisions and Amazon’s ranking algorithm.

Also Read: E-commerce profitable drivers: Digital shelf analytics

For brands, understanding the digital shelf is about more than just being listed. It’s about positioning. The right placement at the right time in front of the right audience is what determines who wins on Amazon.

This is where Amazon Digital Shelf Analytics comes in. By tracking how your products perform across these touchpoints and how they stack up against competitors, you gain visibility into the factors driving your share of shelf.

Why Digital Shelf Analytics Matters for Brands

For brands selling on Amazon, the digital shelf is not just another marketing buzzword. It is the competitive battleground that determines whether your products are discovered, considered, and purchased. Without visibility into how you are performing on this shelf, you are essentially navigating in the dark.

Here’s why digital shelf analytics is critical:

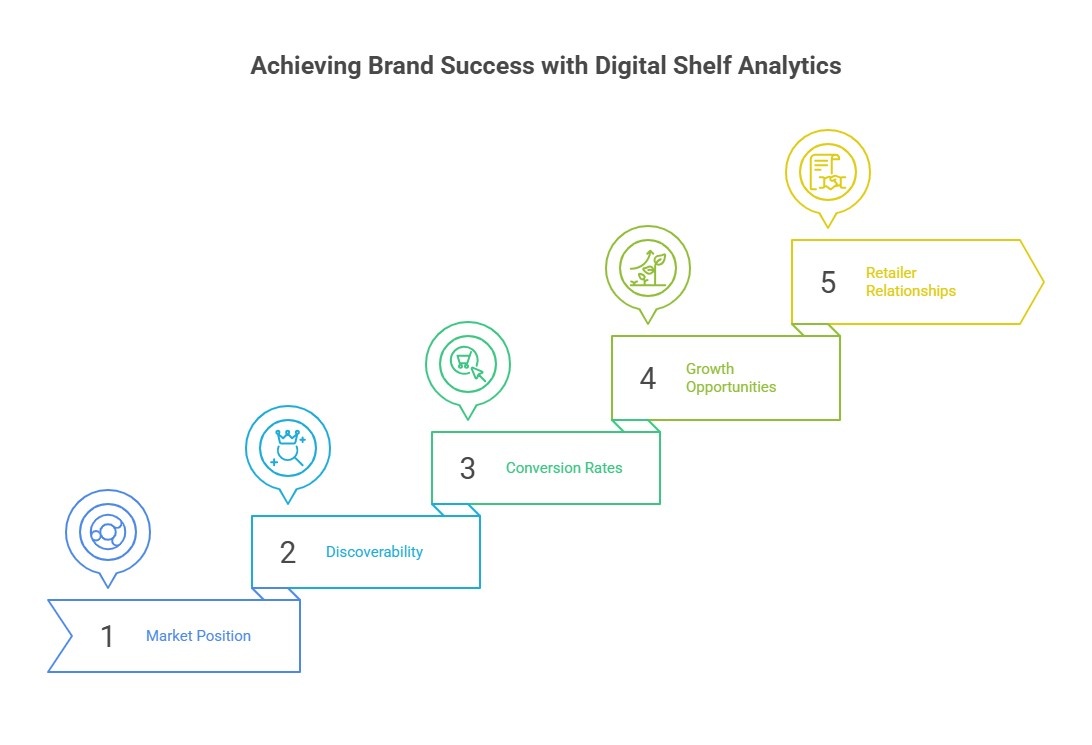

- Understanding Market Position

Analytics provides clarity on where your products stand against competitors in terms of search visibility, pricing, ratings, and reviews. This visibility helps identify whether you are winning share of shelf or losing ground. - Driving Discoverability

Amazon’s algorithm rewards optimized product content, competitive pricing, and consistent sales history. Analytics enables you to measure how well you are meeting these criteria and where gaps exist. For example, if your products are ranking below competitors due to weaker keyword coverage, digital shelf insights highlight this immediately. - Improving Conversion Rates

Even when your products are visible, poor conversion rates can signal problems, unclear content, missing images, or low ratings. Analytics not only points out the issue but quantifies the impact, allowing brands to prioritize fixes with the highest ROI. - Identifying Growth Opportunities

Digital shelf analytics goes beyond reactive problem-solving. It identifies new keywords to target, categories to enter, and pricing strategies that could improve competitiveness. In short, it reveals opportunities you might otherwise miss. - Strengthening Retailer Relationships

Amazon and other marketplaces reward brands that perform well across visibility, availability, and customer experience. By leveraging digital shelf data, brands can proactively address issues before they escalate, building stronger, more reliable retailer partnerships.

Also Read: Total Growth Accountability: New Realities of Digital Commerce

In a marketplace as dynamic as Amazon, intuition alone is not enough. Real-time, actionable data is the difference between a brand that grows and one that simply survives.

This is where tools like Kinator act as a force multiplier. Instead of manually piecing together fragmented insights, Kinator consolidates digital shelf data, benchmarks performance, and delivers clear actions for brands to improve their position.

Key Metrics to Track in Amazon Digital Shelf Analytics

Tracking the right metrics on the digital shelf is what separates leading brands from those struggling to stay visible. On Amazon, where competition is relentless and consumer behavior shifts rapidly, focusing on these core areas is essential:

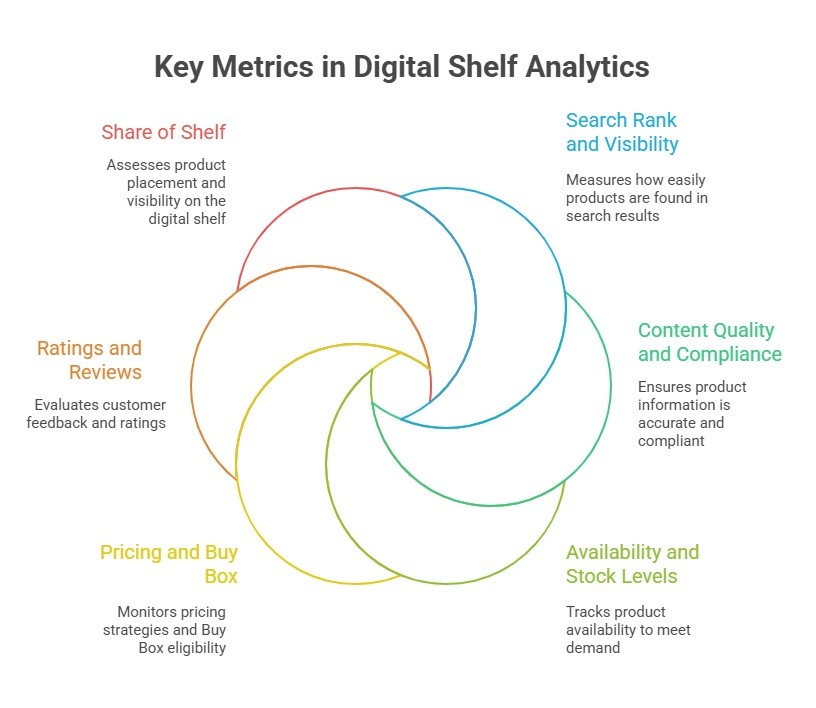

Search Rank and Visibility

Where your product appears in search results is the digital equivalent of being on the top shelf in a retail store. Tracking keyword performance, organic ranking, and paid placements helps determine if your product is easily discoverable.

- Continuously monitors search visibility for your products and competitors, highlighting gaps and recommending optimization opportunities.

Content Quality and Compliance

Product titles, bullet points, descriptions, and images directly influence both discoverability and conversions. Amazon’s algorithm prioritizes content-rich listings that meet best practices.

- Kinator audits your listings for keyword coverage, image quality, and compliance with Amazon guidelines, ensuring your digital shelf is optimized at scale.

Availability and Stock Levels

Out-of-stock products don’t just hurt sales, they harm your rankings. Consistently low availability signals to Amazon that your product is unreliable.

- Tracks inventory health across SKUs, alerts you about declining stock, and forecasts potential stockouts before they impact rankings.

Pricing and Buy Box

Competitive pricing and consistent Buy Box presence are critical to sales velocity. Losing the Buy Box can immediately cut sales.

- Price Violation Tracking – Kinator monitors both authorized sellers, unauthorized sellers and MAP violations across Amazon, flagging risks that can hurt brand value and margin.

- Promo Intelligence – From short-term bank offers to recurring Subscribe & Save discounts, Kinator tracks how competitor promos influence the Buy Box and provides insights on when and how to run your own offers.

- Dynamic Pricing Insights – By combining competitor monitoring with historical sales and Buy Box win rates, Kinator helps brands refine their pricing strategies without leaving money on the table.

Ratings and Reviews

Reviews build consumer trust and directly influence conversion rates and organic ranking. A product with poor reviews will struggle to climb the digital shelf.

- Consolidates ratings and review insights, identifies recurring customer pain points, and quantifies the impact of reviews on performance.

Share of Shelf

Beyond single-product performance, brands need to measure their presence relative to competitors in a category. Are your products dominating category search terms, or are competitors edging you out?

- Calculates share of shelf across categories and competitors, giving you a clear picture of market position and where you need to double down.

By monitoring these metrics, brands can move from reactive firefighting to proactive growth planning. Instead of asking “What went wrong?”, you start asking “What’s the next opportunity?”.

How Kinator Supercharges Digital Shelf Analytics

Most brands know the importance of monitoring the digital shelf, but few have the clarity or bandwidth to act on it consistently. Data is often scattered, insights arrive too late, and teams end up reacting to symptoms rather than addressing root causes. This is where Kinator steps in — not just as a tool, but as a performance partner.

Here’s how Kinator transforms digital shelf analytics into measurable business impact:

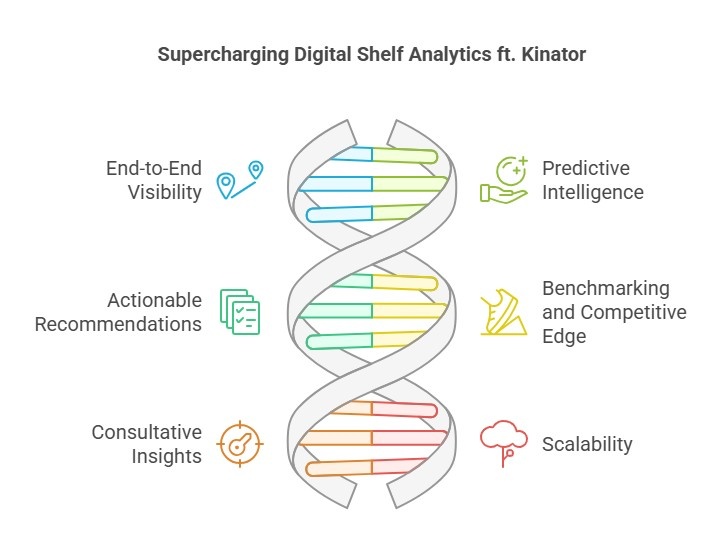

- End-to-End Visibility

Instead of juggling multiple dashboards, Kinator consolidates product, category, and competitor performance into a single lens. Whether it’s keyword rankings, Buy Box share, or review trends, everything sits in one place. - Predictive Intelligence

Beyond tracking what’s happening, Kinator anticipates what’s next. By analyzing sales velocity, stock levels, and competitor movements, it predicts potential risks like Buy Box loss or stockouts — giving you time to act before revenue takes a hit. - Actionable Recommendations

Insights without action are wasted. Kinator doesn’t just highlight gaps, it suggests the steps to fix them, whether that means refining product content, adjusting price & promos, or targeting highest performing keywords for better visibility. - Benchmarking and Competitive Edge

Your performance isn’t just about how you are doing, but how you rank against competitors. Kinator benchmarks your share of shelf, price & promo strategies, and customer sentiment against category leaders, helping you identify exactly where to double down. - Consultative Insights

Kinator isn’t a static platform. It’s designed to act as a partner, offering consulting-grade insights into your Amazon strategy. Instead of raw data dumps, you get narratives that explain why performance is trending a certain way and how to maximize on it. - Scalability Across Teams and Markets

For brands operating across multiple categories or geographies, consistency is key. Kinator ensures standardization of metrics, so global and local teams align on the same truth.

In short, Kinator transforms the digital shelf from a space you compete in to a space you dominate. By unifying data, sharpening insights, and guiding strategy, it turns every product page into an engine of growth.

Conclusion: Winning the Digital Shelf Is Not Optional

On Amazon, visibility is revenue. Products that win the digital shelf aren’t just better displayed, they’re better positioned to earn trust, clicks, and conversions. But as competition intensifies and algorithms evolve, gut feeling and fragmented reporting no longer cut it. Brands need sharper visibility, faster insights, and a proactive strategy to stay ahead.

That’s exactly what Kinator delivers. By combining analytics with consultative intelligence, Kinator helps you move from reactive firefighting to strategic growth. Instead of wondering why sales dipped or how competitors pulled ahead, you’ll have the clarity and the playbook to act with confidence.

The digital shelf is where buying decisions happen. It’s not just about being present, but about being chosen. With Kinator, you don’t just compete on Amazon, you lead.

Ready to take control of your Amazon digital shelf? Let Kinator show you how to turn every product listing into a competitive advantage.

Frequently Asked Questions

Digital Shelf Analytics is the process of tracking and analyzing how your products appear on Amazon’s digital shelf, the search results, product detail pages, ratings, reviews, and competitor listings that influence visibility and conversions. It helps brands understand where they stand, why competitors are winning, and how to optimize content, pricing, and availability.

Because it’s where buying decisions are made. If your products don’t appear in the top results, lack strong content, or miss out on reviews, shoppers will choose your competitors. Winning the digital shelf means better visibility, higher conversion rates, and stronger market share.

In physical retail, shelf space depends on negotiations, distribution, and promotions. On Amazon, visibility is algorithm-driven, based on performance history, content quality, pricing, and customer reviews. That means you can “earn” a better shelf position through data-driven optimization.

Kinator provides brands with visibility into their product performance across Amazon. It monitors rankings, reviews, content accuracy, pricing shifts, and competitor moves. More than just data, Kinator adds a consulting layer, helping you interpret insights and turn them into action plans that boost visibility and sales.

Yes. By identifying content gaps, missed keywords, pricing inefficiencies, or weak review profiles, digital shelf analytics helps optimize every factor that influences Amazon’s search algorithm. That means better rankings, more clicks, and higher conversions.

Brands, manufacturers, and sellers that want to grow on Amazon should leverage it. Whether you’re a small business selling through Seller Central or a large manufacturer using Vendor Central, digital shelf analytics helps you compete more effectively.

Key performance indicators include search rank, Buy Box ownership, stock availability, pricing competitiveness, ratings and reviews, and share of digital shelf versus competitors. Kinator simplifies tracking by consolidating these metrics into actionable dashboards.

It’s both. Tracking is the foundation, but when paired with the right strategy, analytics drive growth. Kinator bridges that gap by combining measurement with consultative recommendations to improve your shelf performance and overall Amazon sales.