Table of Contents

Introduction

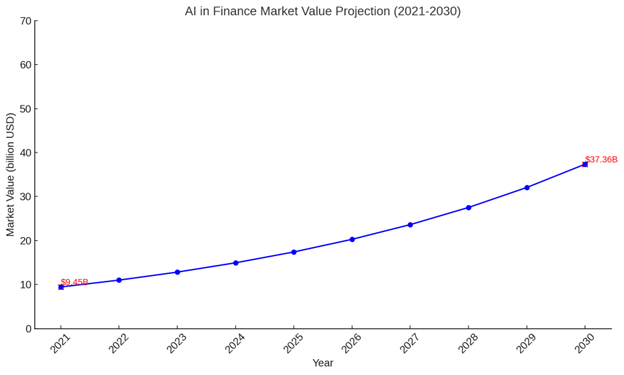

Let’s start with the question of the hour, “Just how big is AI in finance?” It’s Huge. As of 2021, it had a market value of approximately $9.45 billion. And it’s not stopping there—the growth projection runs at an impressive annual rate of 16.5% through 2030. AI isn’t just another tool in the box; it’s becoming the backbone around which the future of finance will pivot.

Edge of AI in Financial Analytics

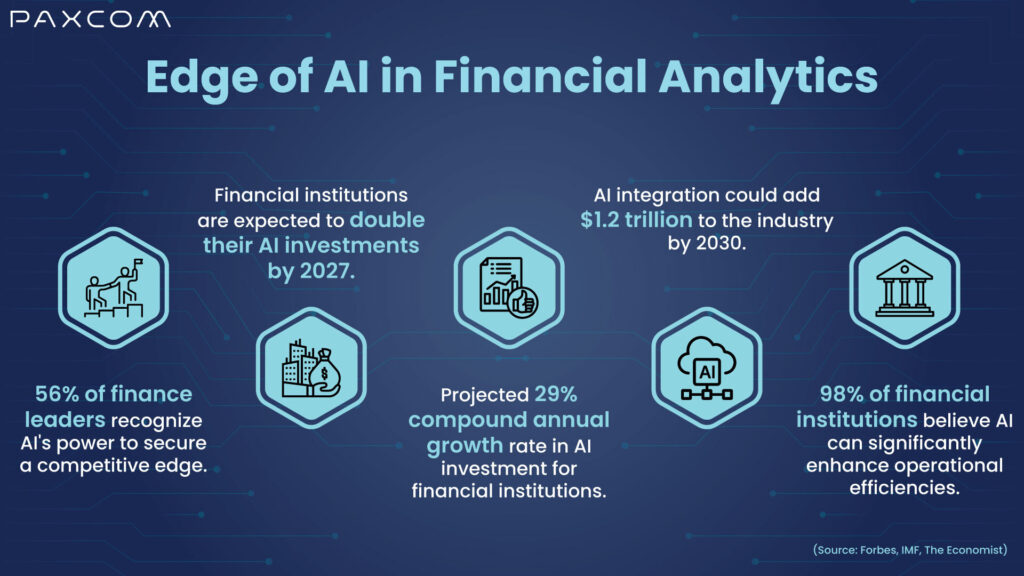

Let’s break it down a bit. Why are financial institutions tripling down on AI investment? According to Forbes, 56% of finance leaders recognize AI’s power to secure a competitive edge. Financial institutions are expected to double their investments by 2027, with a 29% compound annual growth rate.

Think about the potential here—a whopping $1.2 trillion could be added to the industry by 2030 due to AI’s integration. An overwhelming 98% of financial institutions believe AI can significantly enhance operational efficiencies. From fraud detection to IT operations optimization, AI is everywhere, streamlining processes that were once cumbersome and time-intensive.

These figures demonstrate AI’s integral role in modern finance and hint at its future potential to redefine the industry.

(Source: Forbes, IMF, The Economist)

What’s Next? Personalized Financial Services

Areas ripe for growth include tailored investment solutions, credit scoring, and portfolio optimization. Imagine receiving financial advice so specific to your needs that it feels like it’s crafted just for you. That’s where we’re headed with AI in financial analytics.

Emerging AI Technologies in Finance Marketing

- Generative AI: Enhances efficiency, reduces costs and risks, and improves services by supporting decision-making, task automation, and risk assessments.

- Machine Learning (ML): Enables personalized services, opportunity creation, risk management, and operational automation.

- Speech Recognition: Converts speech to text to gain insights from customer interactions, improving customer service experiences.

- Sentiment Analysis: Analyzes emotional opinions in texts to better understand customer sentiments and preferences.

- Anomaly Detection: Identifies fraudulent transactions and financial crimes, enhancing security.

- Recommendation Systems: Offers personalized recommendations for financial products based on detailed customer profiles.

- Translation Services: Makes financial content multilingual, expanding reach and enhancing customer interactions.

AI Innovations in Asset Management

- Portfolio Management and Client Enablement: AI Uses Natural Language Processing (NLP) to analyze market trends and management sentiments, crafting strategies ahead of the curve.

- Predictive Risk Management: Tools like JP Morgan’s LOXM program aren’t just playing the game; they’re changing how it is played by optimizing trading strategies and enhancing equity trade executions.

- Enhanced CRM with AI: Imagine platforms like UBS’s SmartWealth, where AI goes beyond basic advice to provide investment strategies custom-fitted to your financial goals.

- Operational Automation: Companies like Goldman Sachs leverage AI to streamline complex processes, dramatically reducing the time and resources spent on mundane tasks. Imagine reducing hours of work to just a few clicks!

Redefining Financial Analytics Through AI

From Data to Decisions: The AI Advantage

The traditional financial analytics landscape, once bogged down by cumbersome manual processes and limited by the narrow capabilities of early computing tools, is undergoing a profound transformation. AI’s integration into financial systems translates immense volumes of data into actionable insights with precision and speed that human analysts cannot match.

Navigating through Complexity with Machine Learning

Let’s zoom in on machine learning, the superstar of this transformation. These aren’t just any models; they stand at the very forefront of the revolution in financial analytics. Picture machine learning as the savvy navigator through the complex maze of data. It doesn’t just guess trends and behaviors; it learns from past and present data to accurately predict future market movements and customer behaviors.

This isn’t just about making predictions—it’s about making decisions smarter, faster, and more precise than ever before. So, what do you think? Are you ready to see how AI in financial analytics can change the game, turning daunting data into powerful, strategic decisions? Let’s explore this further and see how deep the rabbit hole goes!

Strategic Applications of AI in Financial Operations

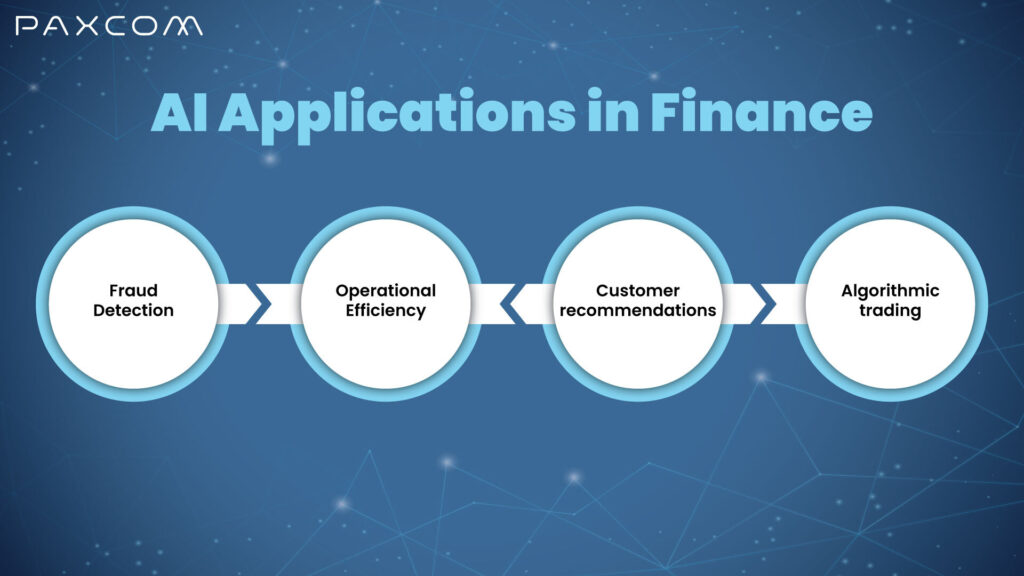

Enhanced Fraud Detection and Security

AI functions as an essential defense mechanism in the financial industry, where security is crucial. By analyzing patterns and flagging anomalies, AI systems effectively reduce fraud risks, protecting institutional assets and customer trust. This includes smarter fraud detection with enhanced algorithms for identifying and preventing fraudulent activities.

Optimizing Operational Efficiencies

AI doesn’t just crunch numbers; it reshapes the entire backend of financial operations. AI ensures everything runs smoothly and efficiently, from risk management to compliance monitoring. Think of it as an automated assistant streamlining compliance processes, ensuring your institution stays within legal boundaries without breaking a sweat.

Personalizing Customer Interactions

Through AI, financial services become deeply personalized. AI’s analytical prowess allows institutions to offer tailored advice, anticipate client needs, and enhance overall customer satisfaction, transforming the client-institution relationship. This includes providing personalized and automated investment advice through platforms, as well as introducing innovative services such as chatbots to improve customer experience.

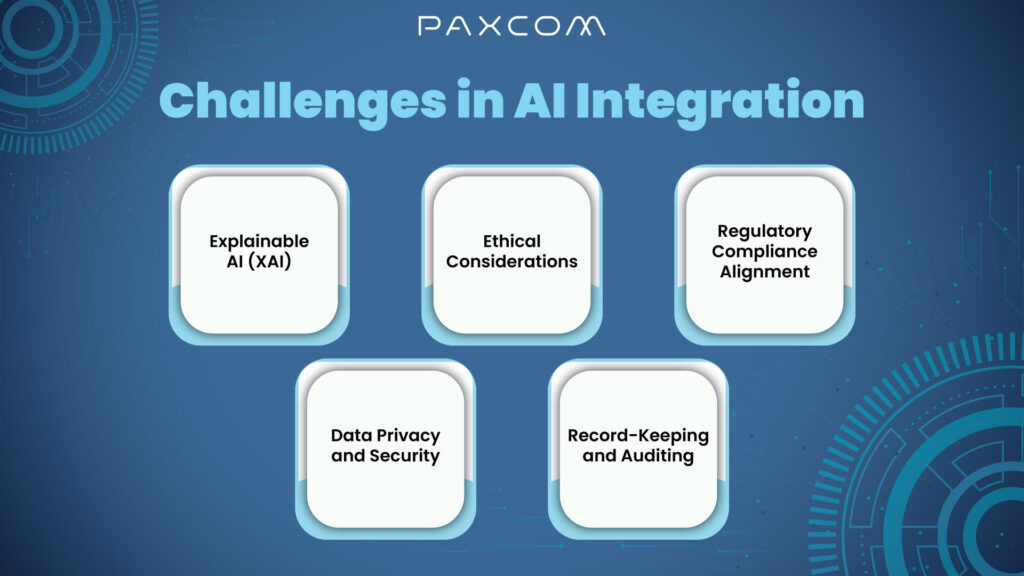

Challenges in AI Integration

While AI promises vast potential, its integration is challenging. Issues of data privacy, ethical use, and seamless integration with legacy systems present hurdles that require strategic foresight and meticulous planning.

- Explainable AI (XAI)

Implementing Explainable AI models allows for clear explanations of AI decisions, enabling human users to understand and verify the decision-making process. This transparency promotes accountability, trust, and regulatory adherence by providing insights into how AI systems arrive at specific outcomes.

- Ethical Considerations

AI systems can be designed to adhere to ethical principles, ensuring fairness, transparency, and accountability in decision-making processes. By incorporating ethical frameworks and guidelines, organizations can address concerns related to privacy, fairness, and human rights implications, thus fostering trust and social responsibility in AI deployment.

- Regulatory Compliance Alignment

Organizations must align their use of AI with specific regulations relevant to their industry, such as GDPR for data privacy or financial industry standards for anti-money laundering. Compliance with these regulations ensures AI technologies’ lawful and ethical deployment, promoting transparency and accountability in financial operations.

- Data Privacy and Security

Robust security measures must be implemented to protect sensitive financial data and ensure compliance with data protection regulations. Techniques like data anonymization can help balance data utility with privacy requirements, safeguard individuals’ data, and ensure regulatory compliance.

- Record-Keeping and Auditing

Comprehensive record-keeping of AI processes, from model development to decision outputs, is essential for regulatory audits and reporting. Maintaining detailed documentation facilitates transparency, troubleshooting, model improvement, and regulatory compliance, ensuring that AI systems operate within legal and ethical boundaries.

The Future of AI in Financial Analytics

The trajectory of AI in finance points towards an increasingly automated and insightful industry. Innovations suggest a future where AI supports and leads financial strategy and operations, fundamentally altering how institutions interact with their data and clients.

Potential Cost Savings

- AI is becoming integral to daily operations in financial institutions, driving efficiency and cutting costs. The role of AI in finance could lead to an estimated $447 billion in potential cost savings for banks by 2023-24. This highlights the significant financial impact AI can have on reducing operational expenses.

AI in Investment Trading

AI algorithms transform stock trading by analyzing vast amounts of data to predict market trends, make informed trading decisions, and automate trades. This enhances decision-making processes and allows traders to exploit market conditions more effectively.

AI Applications in Finance

AI is revolutionizing how people interact with money, offering smarter, safer, and more convenient ways to access, spend, save, and invest. The market value of AI in finance is expected to grow significantly, underscoring the increasing adoption and impact of AI technologies in the financial sector.

Generative AI in Banking

Generative AI is altering the banking industry by:

- Enhancing Customer-Facing Chatbots: Improving customer service with more advanced and responsive AI chatbots.

- Preventing Fraud: Utilizing AI to identify and mitigate fraudulent activities.

- Streamlining Tasks: Automating time-consuming tasks such as code development and regulatory report summarization.

- Centralizing Operating Models: Financial institutions are centralizing their operating models to effectively leverage generative AI and drive impactful use cases into production.

Conclusion

As we stand on the brink of this new era, embracing AI in financial analytics in your financial strategies isn’t just an option; it’s imperative. The institutions that leverage AI effectively will not only thrive but will also shape the future of finance.

Industry Leaders on AI in Financial Analytics

Brett King, Founder of Moven, Says, “The most common form of advice our customers will be faced with in the future from financial services is something as simple as this: ‘Hey, Siri. Can I afford to go out for dinner tonight?’ Your bank account should be smart enough to answer that question.”

Michael Shearer, Managing Director, Group Head of Compliance Product Management, HSBC: “The benefits of AI for us are about the granularity of the detection process. We can be a lot more targeted about what we are looking for using a machine-learning approach than we can be with rules, which catch a lot of behavior that isn’t of concern.”