The trajectory of the Indian beauty market has evolved completely. In a report with Project XV, Redseer reported that the market is expected to touch $30 billion by 2027, with online commerce becoming a significant channel for the BPC industry. Brands have started investing more in personalized skin and body care products as consumers are willing to pay premium costs, resulting in effective solutions and growth.

The beauty and self-care industries have experienced tremendous growth in market sales, and now they are taking over beauty e-commerce. You must be wondering how it happened.

The answer lies in many factors. The first is the digitalization growth in the sector. During the pandemic, online retailers came up with certain advancements to their processes that may have proven beneficial for both them and the customer. One of the changes was to make the product experience look as good as the touch and feel of a brick-and-mortar store.

Beauty products are usually trusted to be bought in stores, making customers lean towards getting a digital experience. Brands using such tactics can attract potential customers to buy their products online.

Through technological advancements in eCommerce, we can now replicate the touch and feel of mainstream beauty shopping through products like lipstick, eye lenses, and other makeup products directly on their faces. Therefore, in the beauty industry in eCommerce, technology contributes to bridging the gap between the seller and the customer.

The beauty industry has attained a key position for consumer goods in eCommerce, and this is what beauty eCommerce platforms must do to stake their claims in the market.

Table of Contents

Beauty eCommerce Category Evaluation, Market Share, and Current Financial Trends in E-commerce

India’s beauty and personal care industry was valued at one trillion Indian rupees in 2020. This industry’s market value is expected to reach two trillion Indian rupees by 2025. (Statista)

Online purchases in India have increased fourfold, from 2 percent to 8 percent, but they are still less compared to countries like the US and China, where they are 30–40 percent, which illustrates that there is room for growth for brands within this market.

Growth of eCommerce channels selling only beauty products

According to a Redseer report, by 2025, eCommerce in India will grow at a CAGR of 25% and is on the verge of becoming one of the top five global markets by revenue.

With the introduction of beauty platforms like Nykaa on a path to the daily customer, India’s beauty industry in eCommerce has been flooded with funds, and with the vast majority of the increase in customers, the time is suitable for the next level of growth.

Ayurveda and the Beauty Industry

As per Euromonitor International, the beauty eCommerce market is projected to reach $17.4 billion by 2025. The Indian beauty market has become a prominent destination for brands to flourish. And to notice, Ayurvedic beauty brands are thriving as alternatives to numerous giants.

Forest Essentials, Kama Ayurveda, Himalaya Herbals, Soul Tree, Juicy Chemistry, and Biotique are well-known Indian ayurvedic brands. Recently, Estee Lauder acquired a 15% stake in Forest Essentials in 2013 to tap into the Indian beauty market and offer the brand global exposure.

In November 2022, Forest Essential acquired its first international address in London’s posh convent garden, making it the first Indian-origin luxury Ayurveda brand to do so. The brand further expanded its presence at Dubai Hills Mall in 2023.

Reasons for Growth

1. Influencers

With the easy accessibility of the internet and smartphones, social media has been a crucial source for providing creators who encourage more people towards new products or services and have created massive fan bases.

They are generally termed “influencers.” These creators form opinions about your product or service and create content for the public, such as tutorials, expert advice, and brand encouragement. As per Business Insider India, customers who buy beauty products spend a lot of time online, with 93 percent checking in more than once a month.

Influencer marketing has recently become a powerful tool in the beauty and self-care markets. With social media at its peak, influencers can attract new and potential customers to brands as loyal followers perceive them as experts in their field of view.

By going through their reviews, the customers can analyze how they have reacted using the same and gain more confidence and trust in the brand, which the brands see as a growing opportunity to capitalize on.

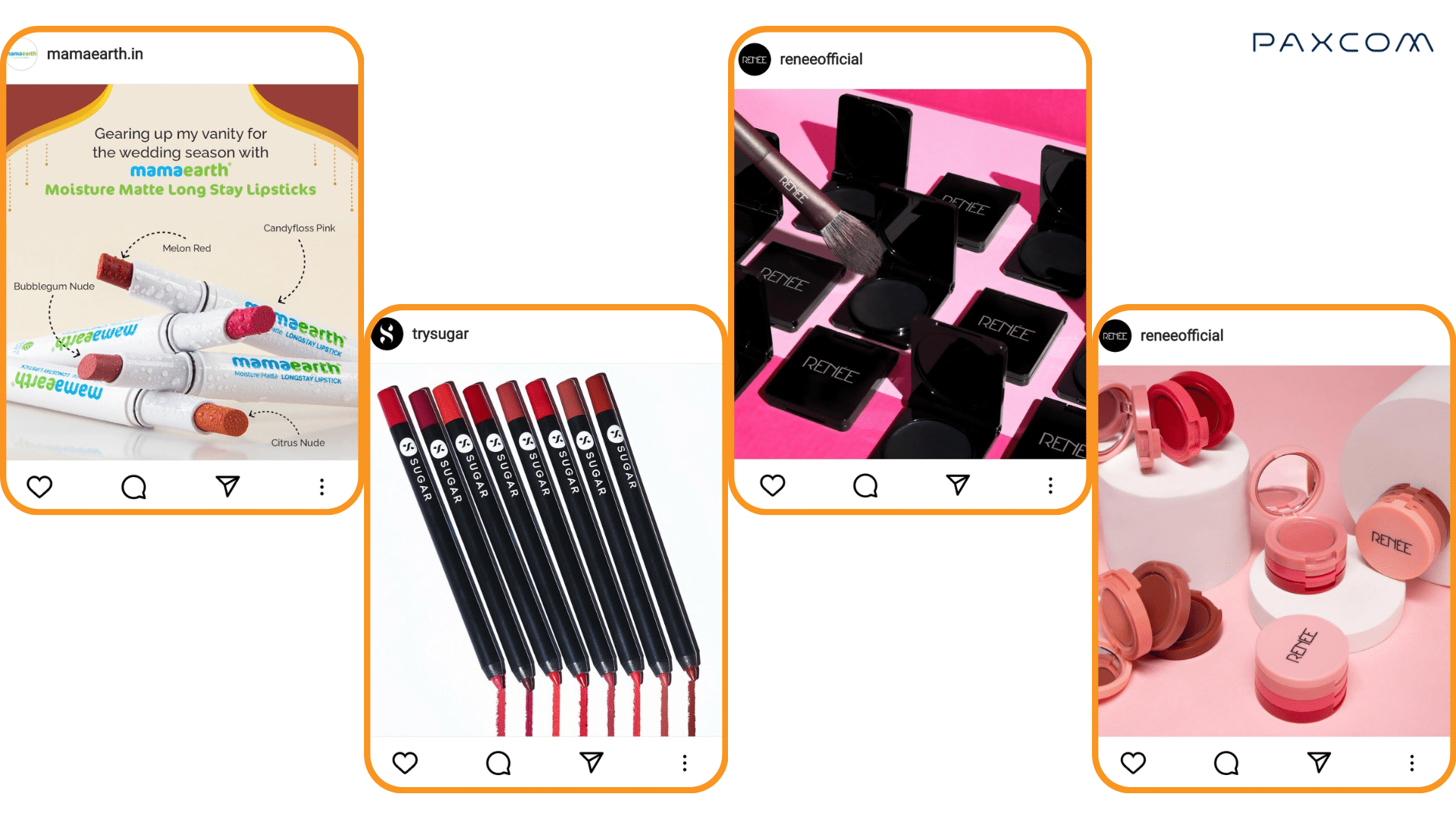

Brands like Mama Earth, which sells natural and chemical-free skincare products, adopted this strategy to create awareness about their products through influencer marketing by running their vast champions on social media platforms like YouTube, Instagram, and Facebook.

Platforms like Amazon also launched the #fountItOnAmazon strategy, where influencers suggest or recommend their favorite products to the audience, creating a sense of trust towards the brand and boosting sales.

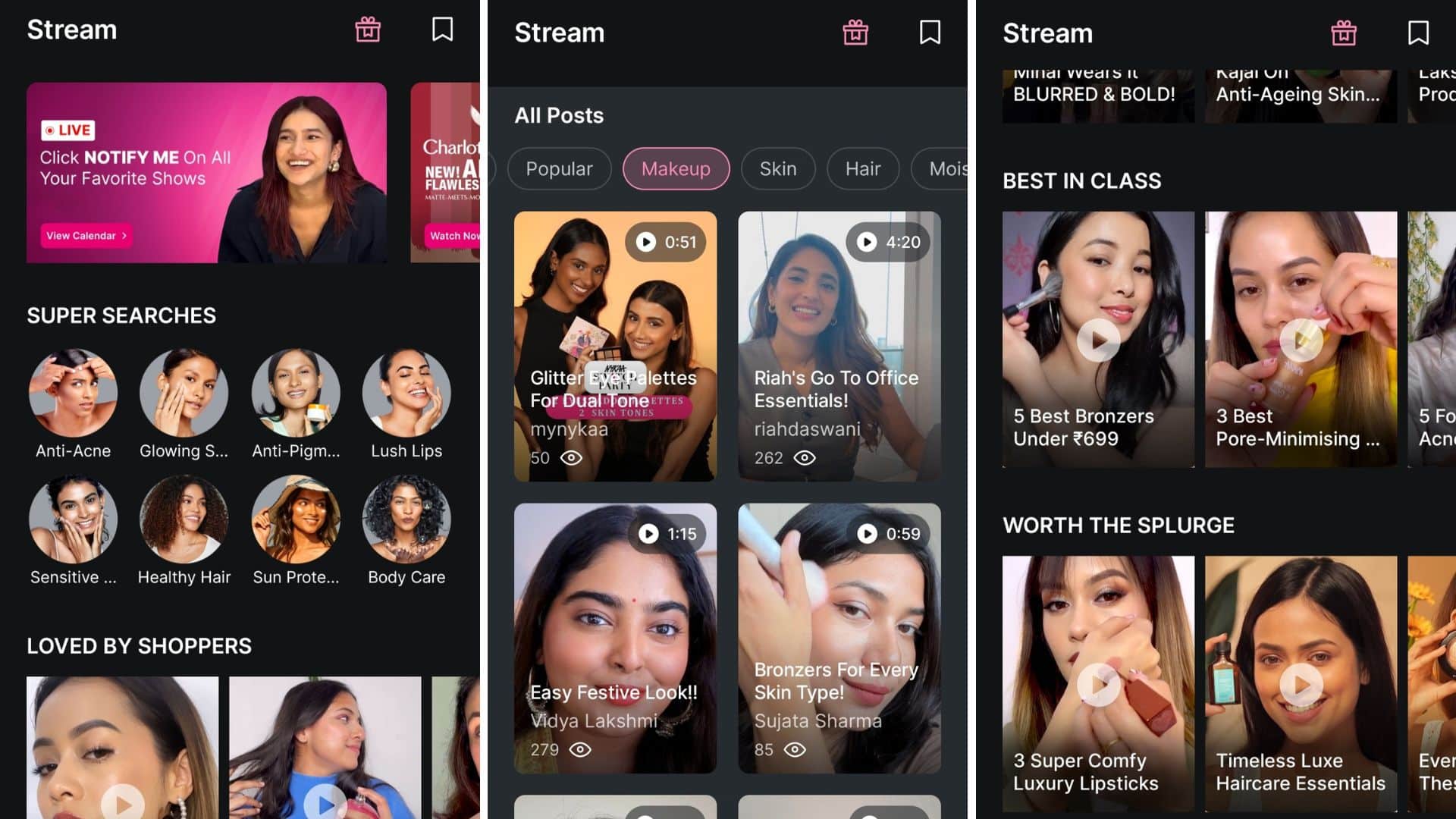

Nykaa has introduced personalized live streams and shopping events in collaboration with the influencers. ‘Nykaa Army,’ ‘Best body care products for winter,’ ‘Nykaa Army- Approved,’ ‘Worth the Surpluge,’ and similar related trends can be found on the app. The brand embraces the format to drive traffic and empower customers to try new products by offering time-sensitive discounts through the sessions.

2. D2C Model

The D2C model has been gaining popularity recently; these are determined to attract customers online. With the lockdown imposed in most countries, brands have found a new way to sell their products to customers directly.

This change, i.e., shifting from traditional methods to direct selling from their websites, has promoted adopting the D2C model.

The D2C model is already a hit in the United States and other countries, providing customers with a personalized, need-to-order basis. Some premium brands also provide subscribe and save offers curated personally for the customers in the form of a monthly box or a subscription, providing the user and brand with a great partnership that leads to a happy customer.

Indian brands like Sugar, Mama Earth, WOW Science, Renee Cosmetics, Ustraa, and Bombay Shaving Company are using these models, gaining a lot of visibility and having an emerging user base.

Prominent D2C Beauty & Personal Care Brands

Beauty brands are moving fast toward adopting e-commerce strategies aligned with online customer behavior. The Indian D2C market value will be approximately USD 12 billion in 2022. The same is projected to surpass USD 60 billion by 2027, growing at a CAGR of 40 percent(Source- KPMG).

3. Technology

The evolution of technology has played a significant role in how we usually interact daily, be it by making us more socially aware or revamping our lifestyles from the ground up. People have become more inclined towards self-care, changing how we purchase things.

We can now have suggestions and choose from a vast product range with reviews from influencers and previous buyers. Customers buy everything from homemade organic beauty products to monthly skincare products online.

Every day, we discover new emerging brands and products on different beauty platforms, like social media feeds or YouTube ads. And to our astonishment, the reviews from people on the internet are proving to be the most significant factor in the sale and success of a product.

Customers’ attention has shifted to global markets due to easy access to resources such as videos and reviews online. As a result of this technological advancement, e-stores like Nykaa provide a broad range of international beauty brands.

These marketplaces also try to close this gap because touch and feel dominate the segment.With the support of increasing disposable income and economic strength, this field has allowed businesses to look forward to a new opportunity in the beauty and cosmetics vertical.

With the support of increasing disposable income and economic strength, this field has allowed businesses to look forward to a new opportunity in the beauty and cosmetic vertical.

What are the driving factors behind category sales in India’s beauty industry in eCommerce?

-

- Digital presence: the visibility of a brand online is its digital presence. The more traction it gets online, the more chances it has to grow.

-

- Product innovation: Products are now being created while considering the user’s needs. Brands focus on how products can be more helpful to people by using methods like surveys, in-house research, customer reviews, and many others.

-

- Pricing strategies: With the market offering several different alternatives within a single product category, brands are forced to initiate competitive pricing, keeping growth and profit in mind.

Prominent Beauty eCommerce Key Players of India

-

- Nykaa

- Tira Beauty

- MyGlamm

- Amazon

- Sephora

- Myntra

Final Thoughts

As we see, the beauty eCommerce market is flooded with new players every day. Existing brands might have to adjust to the current perspective and policies of the growing demand. Viewing the point that Nykaa has introduced the men’s grooming page to its platform, which is an often ignored aspect, might prove to be a game-changer.

Over the years, Paxcom has helped many brands launch and grow their brands on Amazon and other major e-commerce platforms. Whether your brand is already established or plans to enter the market, Paxcom has covered you.

To learn more about how we assist brands in creating a solid presence, growing, and skyrocketing sales, contact us at info@paxcom.net