Size of SEA eCommerce Market & it’s Potential

If you are looking to expand your online retail reach in a new territory and have stumbled upon SEA, then you are most probably on the right track. Let us tell you how –

Digital retail in Southeast Asia almost grew +80% YOY in the last few years, and SEA eCommerce made $120 billion in 2021, which is one of the top ten regions with the highest online retail sales last year.

China, Brazil, and India’s growth have been surpassed by Southeast Asia by 5%, 14%, and 10%, respectively, according to Facebook and Bain & Company’s annual SYNC Southeast Asia report.

Praneeth Yendamuri, a partner in Bain & Company’s consumer products, added:

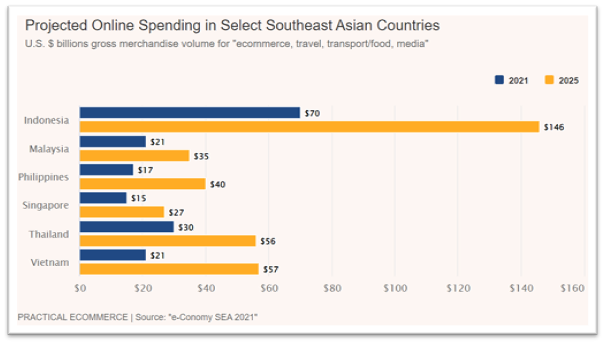

Coming to the country-wise online retail sales potential, Indonesia is the region’s biggest overall digital economy projected to hit $146 billion online spending alone by 2025.

As you will see below, Vietnam is one of the fastest-growing online economies in SEA.

Take a look at the projected online spending in selected Southeast Asian Countries –

There is no better time for brands to enter this market than now! The moment has arrived when brands can take advantage of SEA’s growing online retail market.

Table of Contents

What SEA e-Commerce Consumers are looking for

- In a survey, it was revealed that the SEA audience is open to discovering new products or services; 65% of customers were unsure what to buy when shopping online, while 51% said they purchased from different online stores, which were not known to them before.

- About one in every third person expected to work from home even after improved covid situation and 9 out of 10 executives believe post-pandemic a hybrid WFH model to be the new trend – As more and more people continue to follow the hybrid work from home culture, eCommerce will become more prominent and in sometimes customers first choice of shopping.

- Customers now visit an average of 7.9 websites compared with 5.2 websites in the year 2020 before making a purchase – depicting a significant increase.

Source – The Drum

Top Online Marketplaces in SEA Region

SEA is one of the fastest-growing eCommerce markets, but even the most prominent online retailers such as Amazon and other western players are yet to make their mark. On the other hand, local marketplaces are leading their way.

Shopee in SEA

Shopee was launched in 2015, and it went from a newbie in the SEA market to becoming the top eCommerce channel. Shopee provides its shoppers with an escrow service where the buyers only have to pay when the product has been delivered. 9:9 shopping day, “SuperBrand Days” featuring global brands, Single’s day on November 11th, etc., are some of the important promotion and sales events that Shopee prepares for.

Tokopedia in Indonesia

Tokopedia was launched in 2009 by two Indonesian entrepreneurs. The name of their startup came from ‘Toko’, meaning “Shop” and encyclopedia. Sellers selling on Tokopedia need to have a security deposit of 2% to 15% depending on their fees. Tokopedia does not support cross-border sales currently; international brands need to have a local office or distributor to sell their products.

Lazada in SEA

Lazada (acquired by Alibaba in 2016) was launched in 2012. It basically has three parts to its platform – The marketplace for local sellers with no commission fees, The Lazmall for brand owners and distributors, which charges a minimum 5% commission, and Laz Global for sellers based out of China, Taiwan, South Korea, Japan & UK, and some other international sellers. For Fresh Food supplies, RedMart in Singapore & Lazada Fresh in the Philippines run under Lazada.

Also, let’s not forget the double-digit thematic sales that start from March. All the love for shopping and entertainment comes together.

Zalora – The Fashion Retail online store in SEA

Zalora is a retailer as well as an online fashion marketplace with over 7 million monthly visitors from across Southeast Asia. For Zalora, Indonesia occupies the largest market share, followed by the Philippines, which Singapore follows, and then followed by Malaysia.

Top 4 Product Categories to Sell in Southeast Asian Online Marketplaces

1. Fashion, Beauty Care & Clothing

One of the most competitive online retail categories in SEA is Fashion & Beauty retail. Almost 20% of women in SEA are buying online, and the purchasing power of women worldwide is a known fact.

If you are a seller planning to tap this category in SEA, then fashion and beauty products like apparel and footwear, shapewear, watches, accessories, etc., are worth considering if you’re willing to enter.

2. Furniture & Home Decor

Home decor & furniture is a category which can help you make a good amount of money if you understand the local market and the customers’ living habits. Lazada sells furniture at lower prices, better quality, and exciting designs.

The pandemic brought with it its own demand for bean bags, home furniture, bed tables, wood crafted furniture, etc., in the SEA market.

3. Baby Products

Southeast Asia is probably one of the best markets for online baby products, with 10% of households having children aged 0-2 years. Inkwood (market research company) shows that Southeast Asia holds a 30% market share in the Baby Products category. With the growing standard of living of southeast Asian parents, they want the best for their children, from toys to diapers to baby food products.

4. Electronics

Electronics is again one of the prime online retail categories in the SEA market. SEA audience is one of the most tech-savvy and advanced customers to make the best out of gadgets, from smartphones to TVs & laptops.

Customer’s Online Shopping Behaviour in SEA

Customers in SEA spend around 7-12 minutes daily on eCommerce sites browsing for products, according to an iprice report. These crucial minutes are all you have to showcase your brand among the crowd. Let’s see some online shopping patterns observed in the last year in the SEA Market –

Online Grocery Shopping: Researchers have observed a 44% to 48% increase in packaged products and fresh grocery online shopping during the pandemic in SEA, according to a joint report by Facebook & Bain & company. While this initially seemed like a short-term trend, almost 80% of southeast shoppers have stated that they will continue to shop online for their basic necessities even after the pandemic ends.

Increased Spends during Festive Sales: Southeast Asia is known for its online shopping sales events. SEA online retail channels are known to gather the maximum crowd and highest sales these days. With a 56% increase in consumer spending compared to a typical day, online sales events are crucial for eCommerce businesses targeting Southeast Asian users.

Researchers have also discovered that Singles Day (November 11) is the most prominent event where SEA customers have spent 74% more than any typical day.

Mobile Apps are the way to Key Growth: The Facebook study confirms that 85% of SEA digital consumers have tried new digital smartphone apps in Q1 2020. Among these, the eCommerce apps scored the third position for the first time use.

Understanding SEA’S Online Festive Shopping Market

As concerns over social distancing and lockdowns continue to stay on top of the mind, 93% of the respondents, according to an InMobi festive season consumer survey, plan to leverage online channels this year, with 33% of them having concrete plans to buy from festive year-end sales. They plan to purchase a wide range of products including-

• Gadgets (Smartphone, tablets, etc.)

• Home Appliances (Refrigerators, televisions, coffee makers, etc.)

• Clothing & Accessories (Clothes, bags, shoes, etc.)

SEA e-Commerce Event Calendar 2022

SEA e-Commerce post-Covid

In six Southeast Asian countries in total, more than +70 million customers purchased online since the pandemic hit, as per the Bain Company and Facebook report.

It also predicted that the no. of online southeast Asian shoppers will reach 380 million by 2026. The survey also stated that the share of respondents who “mostly shop online” also rose from 33% to 45% in 2020, with tremendous gains from Singapore, Malaysia & the Philippines.

With eCommerce gaining traction, financial convenience features like “BNPL (Buy Now Pay Later),” “e-wallets,” and “Cryptos” have become popular.

While 37% of respondents preferred digital wallets, 28% preferred cash, 19% chose debit or credit cards, and 15% preferred bank transfers. Digital wallet saw the highest growth in the Philippines (133%), Malaysia (87%), and Vietnam (82%).

Digital trends and immense growth in Southeast Asia’s digital economy show great promise for the region.

Top Trends in SEA e-Commerce Market

From categories like electronics which are ruling the SEA eCommerce market, to baby products which contribute almost 30% to the overall share, there are multiple opportunities to excel in this market. But it would be even beneficial if you take advantage of the running digital trends to make the most out of this unprecedented growth in eCommerce.

Live Streaming – Used to promote giveaways, discount offers, create a sense of urgency for buying products, connect one-to-one with customers, answer their queries, etc. Statistics show that Malaysia & Singapore saw a 200% increase in live streaming hours on eCommerce platforms, whereas the Philippines saw 60% of brands using live streaming to invite new customers.

Blockchain as a payment option allows customers to have a digital payment option without even owning a bank account. Blockchain can give you a competitive edge if you integrate it with your store.

Social Commerce: If you are someone who loves creative ways to do business, then social commerce is for you! It’s the most perfect combination that exists. Creating shoppable posts on Instagram and Facebook marketplace can help you extend your reach and customer base.

Analytics for better decision making – If you are a seller selling on multiple platforms, then keeping track of your product data is manually impossible with your comprehensive portfolio of products and no. of channels. You need a tool that can simplify this process for you. Brands are heavily investing in data analytic tools to make their lives easier and to make better online business decisions. Metrics like your product’s stock status, category and keyword ranking, reviews analysis, content scorecard, advertising analysis & competitor metrics are some of the essential ones that are supposed to be tracked on a daily basis.

Explore Paxcom’s eCommerce Data Analytics tool here.

Final thoughts & How can Paxcom Help you?

We saw the enormous number of opportunities that SEA eCommerce is bringing for the local as well as international brands. With SEA being one of the most tech-friendly regions to it adopting all the new trends, it is also becoming one of the most favorable regions for brands to explore.

At Paxcom, we have helped global brands reach their online retail potential. Brands like Abbott, 3M, and others are actively engaged with Paxcom for various services, including eCommerce promotions management, content & design, brand store creation, eCommerce advertising, customized data analytics, etc., to maximize their reach and sales in the SEA region.

We can assist with more details at – info@paxcom.net